|

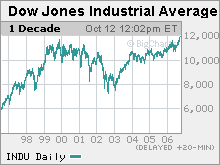

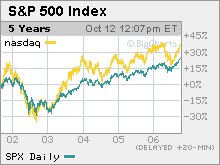

Earnings rock ... so far The market is celebrating a strong start for earnings. But with many big firms yet to report, it's probably too soon to get excited. NEW YORK (CNNMoney.com) -- Bust out the bubbly and party favors. Happy days are here again on Wall Street ... at least for now. But some market experts think investors shouldn't get too optimistic. First, the good news. The Dow hit a new record trading high Thursday and the S&P and Nasdaq are at their highest levels in about five years. Oil prices are retreating and the economy, while showing some signs of slowing, still appears to be in relatively healthy shape.

And perhaps the best news for investors is that so far, third-quarter earnings season is off to a good start. Consumers holding up well PepsiCo (Charts) reported better than expected earnings Thursday while McDonald's (Charts) raised guidance. Retailer Costco (Charts) also reported a positive earnings surprise Thursday. And earlier this week, companies ranging from Indian outsourcing firm Infosys to software maker Parametric Technology boosted their financial forecasts. "So far the numbers have been good, there's no doubt about it," said John Butters, research analyst with Thomson Financial. Financial services firms also have done a bit better than expected, with investment banks Goldman Sachs, Lehman Brothers and Bear Stearns all reporting last month that their profits that beat forecasts. Subodh Kumar, chief U.S. investment strategist with CIBC World Markets, said that's a good sign since many investors were worried about the impact the Fed's series of interest-rate hikes, which began in June 2004 and ended, at least temporarily, in August, would have on earnings for banks. But it's the strong results from consumer-oriented companies that are particularly encouraging, said Brian Stine, investment strategist with Allegiant Asset Management Co. in Cleveland. In addition to the healthy reports from Pepsi, McDonald's and Costco, restaurant chain Yum! Brands (Charts) also beat expectations and raised guidance. Stine said that even though a lot of headlines are focusing on weakness in the housing market and what that might mean for the consumer, there are other positive signs in the economy that could bolster consumer confidence and spending. "I think the consumer is in better shape than most of us realize. Long-term interest rates have been declining since the Federal Reserve paused in August and oil prices are declining. And there may be a little bit of a wealth effect with the stock market hitting new highs," he said. Jeffrey Saut, chief investment strategist for Raymond James, agreed that the decline in oil and gas prices could be good news for consumers...at least in the short-term. "You don't have to sell your house every day but you do have to drive everyday," he said. But growth may start to slow However, Saut added that he thinks earnings momentum may start to slow after the third quarter due to a weakening economy. Butters also cautioned investors to not get too excited about this week's results. He points out that only a handful of companies have reported third-quarter earnings so far. Over the next two weeks, more than half of the companies in the S&P 500 will release their latest results. "We have had such a small sample of companies reporting. I want to see where we stand at end of the next two weeks," he said. Despite this week's good news, Butters said that earnings estimates for the S&P 500 have not gone up lately. Analysts still expect profits for the S&P 500 to increase 14 percent from a year ago, unchanged from the beginning of the month. And Kumar predicts that earnings will fail to hit that target. He thinks that profits will only wind up increasing by 11 percent. "Momentum is slowing down," Kumar said. "Concerns of a slowing economy have not gone away." Plus, the earnings news hasn't been all good. Biotech Genentech (Charts) reported Tuesday that sales of a key cancer drug were lower than what Wall Street was expecting. And aluminum producer Alcoa (Charts) posted a third quarter profit Tuesday that missed forecasts. That could be a sign that the basic materials sector, which along with the energy group has been among the market's leaders this year, may be set to cool off now that the price of oil and other commodities are starting to slip. Butters said that healthcare companies should be among the worst performers in the third quarter, with earnings expected to increase just 1 percent from a year ago. And looking ahead to the fourth quarter, he added that earnings estimates for energy and materials companies are starting to come down. Safety in multinationals and energy? There could be some ways for investors to protect themselves though if earnings start to slow. Stine said he's focusing mainly on the largest of large cap companies since they should be able to benefit from stronger economic growth overseas. Stine said that while gross domestic product (GDP) growth in the U.S. is likely to be slightly below 3 percent in the U.S. next year, GDP outside the U.S. could be about 5 percent. "Global growth is faster than the U.S.'s growth and most big U.S. corporations are multinational corporations that should benefit from this," he said. And Saut said he thinks that energy stocks are still a relatively safe bet for investors, especially if the economy does weaken. He points to the high dividend yields that many oil companies and natural resources mutual funds offer and said that these payouts will protect investors even if oil prices continue to fall. "I like the energy patch. It's going to be tough to lose money with some of these high yields," he said. |

|