|

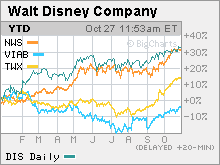

Disney's better Internet Mouse trap The media giant has stood by while rivals scoop up startups like MySpace and YouTube. Does Disney need to make a big acquisition? NEW YORK (CNNMoney.com) -- That real estate slowdown you keep reading about? It certainly isn't taking place in the virtual world. Sellers of Internet properties are having no trouble finding buyers. Big media companies are tripping over themselves in an online land grab. Google (Charts) agreed to plunk down $1.65 billion for YouTube earlier this month. Also this month, Viacom announced that it was buying Quizilla, a Web site catering to teens. That deal comes on the heels of Viacom's (Charts) purchase of online video site Atom Entertainment for $200 million in August. Sony bought online video firm Grouper for $65 million in August. GE's NBC Universal ponied up $600 million for iVillage, a network of sites that focuses on women, in March. Time Warner's (Charts) AOL has bought three firms with social networking or online video ties this year. (Time Warner also owns CNNMoney.com.) And, of course, News Corp (Charts). shelled out $590 million last year for Intermix, parent of the social networking phenomenon MySpace. But one big media firm has been notably absent from the merger wave sweeping across the Web: Walt Disney (Charts). And while Wall Street speculates about who might want to buy privately held social networking company Facebook, news site Digg and other online upstarts, Disney's name is rarely mentioned among the list of possible suitors. Still, does Disney need to make a splashy Internet deal? Steve Wadsworth, president of Walt Disney Internet Group, said that the company isn't averse to making an online acquisition but that it has to be at the right price. He adds that there are few Internet companies that have wound up selling out recently that Disney hasn't looked at but that, ultimately, it was more sensible to not pursue deals. "To pay what is, on the surface, significant amounts of money doesn't make sense for us. For others it may make sense. We are concerned about valuations," he said. Disney's strategy is a stark contrast to its media rivals. But it could turn out to be the most prudent and sound. After all, Disney seems to be the one media firm that still remembers the last time there was a rush to embrace the Web and how painful that turned out. In the late 1990s, Disney spent more than $2 billion on Web search firm Infoseek, changed the name to Go.com and then set up a tracking stock for this Internet unit. After the dot-com bubble burst, Disney shut down most of the site's operations in 2001 and converted the tracking stock back into Disney common shares. "One of the things that were learned in the late '90s is that you have to have a sustainable business model to justify the investments that companies have made and are making online," he said. Wall Street likes the strategy And investors apparently aren't too upset by the fact that Disney doesn't have its own MySpace or YouTube. Shares of Disney have surged 33 percent this year, and the stock has vastly outperformed most of its major media rivals. Plus, it's not as if Disney is shunning the Internet. It has just chosen, so far, to focus more on establishing a strong presence through Web sites for its existing brands such as ABC, ESPN and, of course, Disney. "Disney has more of a build mentality. I think that it is their strategy - to extend brands rather than buy new ones. I don't think they need to mimic what News Corp. and others have done," said David Joyce, an analyst with Miller Tabak & Co. According to research from Web traffic firm comScore Networks, the Disney Online, ABC and ESPN network of sites had more than 45 million visitors in the United States during September, ranking it in the top ten just behind IAC/InterActive's Ask network of sites and Fox Interactive Media, which includes MySpace. "That's pretty substantial," notes comScore analyst Andrew Lipsman. Disney was also the first media firm to partner with Apple (Charts) to sell TV shows on iTunes and was the first company to offer free, though ad-supported, streams of some of its hit shows on ABC.com. And this already appears to be paying dividends. When Disney reported its fiscal third-quarter results in August, Chief Executive Officer Robert Iger said during the company's conference call that Disney was on track to report about $1.2 billion in online sales this fiscal year, which ended in September, or about 3.5 percent of total estimated revenue. Disney Chief Financial Officer Thomas Staggs clarified later in the call that more than half of digital sales came from online booking of travel packages for Disney's theme parks. He said that other digital revenue, such as download sales and online advertising, should come in "north of $500 million." And that's before Disney started selling movies on iTunes in September. Iger told investors at a Goldman Sachs media conference in New York in September after that deal was announced that Disney could easily generate $50 million a year in movie download revenue. Wadsworth confirmed that Disney was on track to meet the digital targets that Iger and Staggs laid out in August for the fiscal year that just ended. He would not disclose specific numbers but said that Disney should see "significant growth" in digital revenues in fiscal 2007. So what's next for Disney now that many of its competitors have bulked up their online offerings? Richard Dorfman, managing director with Richard Alan Inc., a financial advisory and investment company focusing on the media industry, said he thinks Disney won't stay on the sidelines indefinitely. He commented that that Iger appears to get the Internet more than his predecessor Michael Eisner did and that the presence of Apple CEO Steve Jobs on Disney's board will also cause Disney to move more aggressively. "Ultimately, Disney will get off the sidelines because Iger is a different guy and Jobs will also help them see the light. They may be making a mistake if they keep quietly sitting by," he said. But Wadsworth said the company won't deviate too drastically from its strategy. He said that Disney already has a strong presence in social networking when you consider offerings such as fantasy sports on ESPN.com and Disney Online's Toontown, an interactive role-playing game that lets people create their own cartoon character. In other words, Disney has no desire to copy what its rivals are doing. "Social networking and communities are important parts of what we do. But for us, it's in the context of sports, family and kids' entertainment," Wadsworth said. "To do a pure stand-alone MySpace competitor where you can create your own page is not something we have the intention of doing." But Dorfman thinks Disney would be wise to make a bigger foray into user-generated content instead of just relying on sites for Disney-owned brands. "We have finally reached the juncture where the Internet is creating its own forms of content. That is a very big shift. There is content that's independent of Mickey and Minnie Mouse," he said. Analysts quoted in this story do not own shares of Disney, and their firms have no investment banking ties with the company. The reporter of this story owns shares of Time Warner through his company's 401(k) plan. |

|