|

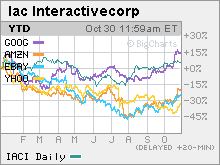

Diller's Net bet: Nice 'Ask' Shares of Barry Diller's IAC/InterActive, parent of search engine Ask.com, are up this year. The only other major Net stock in positive territory is Google. NEW YORK (CNNMoney.com) -- Internet stocks, by and large, have not been good investments this year. Amazon, eBay and Yahoo rank among the worst-performing stocks in the S&P 500. But there are some exceptions to the rule. It should come as no surprise that Google (Charts) has bucked the bearish trend. Thanks to strong earnings and optimism about its pending acquisition of YouTube, Google's stock is up 15 percent and recently hit a new all-time high. However, another not so well known Internet stock is also in the black this year: IAC/InterActive (Charts). Shares of the Web conglomerate, run by media mogul Barry Diller, the man who started the Fox television network, are up 5 percent this year. Not bad for a company that's decidedly less glamorous than Google and also a lot more difficult to understand. Unlike Google - which can easily be summed up by one word (advertising) - IAC is a hodgepodge of businesses, including search engine Ask.com, mortgage financing site LendingTree, dating service Match.com and Ticketmaster. IAC also owns the Home Shopping Network, a business that has struggled in recent years. So why is Wall Street betting on Diller? For one, the company is starting to benefit from changes it made to Ask.com earlier this year. Ask.com, formerly Ask Jeeves, dumped the butler character and launched an aggressive marketing campaign touting new features such as maps that feature walking directions and a spotlight function that allows users to see a preview of a Web page they found in Ask's search results. This appears to be working. Although Ask.com still lags search leaders Google, Yahoo (Charts) and Microsoft's (Charts) MSN in market share, Ask has been gaining ground. According to figures from comScore Networks, only Google and Ask.com posted a year-over-year gain in search market share from a year ago in September. Rankings from Nielsen//NetRatings also show strong growth. Although Nielsen has Ask.com in fifth place in search, trailing Time Warner's (Charts) AOL in addition to the other big three, Nielsen reported that searches on Ask.com rose 19 percent in September from a year ago. (Time Warner is the parent company of CNNMoney.com.) Only Google, with a growth rate of 24 percent, grew faster than Ask.com. In addition to improving trends in search, IAC has benefited overall from decent earnings and Wall Street's relatively low expectations. During the past four quarters, IAC has surpassed analysts' consensus estimates by an average of 15 percent. And IAC did it again when it reported its third-quarter earnings Tuesday. The company reported earnings, excluding charges, of 35 cents a share. Analysts expected a profit of 33 cents per share on this basis. Shares rose nearly 5 percent in pre-market trading Tuesday on the news. Michael Millman, an analyst with Soleil-Millman Research Associates, an independent research firm, also said that IAC is no longer being penalized by investors for having a broad reach. "The company's earnings over the past couple of quarters have been better than expected and the market is looking for companies with interesting opportunities online. IAC has its fingers and toes in a number of places," he said. Scott Devitt, an analyst with Stifel Nicolaus, adds that IAC is also benefiting from the fact that the company spun off its Expedia (Charts) online travel segment last year. Tough competition in that business ate into profit margins and also made the already complex IAC even more difficult to value. "Shedding the travel asset was a positive. IAC can now be more focused," he said. HSN needs to shape up Still, analysts think it may be tough for IAC to build on this year's gains. Millman points out that the Ticketmaster business is maturing and that LendingTree could struggle in the months ahead if the real estate slowdown persists. IAC also owns RealEstate.com, which generates leads for brokers and agents. So that business also could take a hit if the housing slowdown continues. And despite the increased momentum at Ask.com, it's not as if IAC has succeeded in making the search engine a significant player just yet. According to comScore, Ask's market share was just 5.8 percent in September. "They still have got a lot of work to do to make Ask a major competitor in search. To some extent, the headwinds facing the company have been discounted," Millman said. "I wouldn't be buying the stock here." Devitt agrees. He said that improvements at Ask and other IAC divisions may not be enough to compensate for continued weakness at IAC's offline retail businesses. In addition to HSN, IAC also owns catalog retailer Cornerstone Brands. IAC's retail businesses accounted for nearly half of the company's overall sales in the second quarter and more than a third of operating profits before amortization. But sales only increased by 2 percent from a year ago while operating profits declined 1 percent. "It will take a lot from smaller categories like Ask.com to move the needle," Devitt said. "IAC expects more growth from smaller Internet assets. But the transition will take time and the company's overall growth rate is still going to be in the single digits." To that end, Wall Street only expects IAC's sales to increase by 9 percent in 2007. And that's IAC's biggest problem. For now, Wall Street is applauding the steady improvements but at some point, investors will want to see revenue and profit growth rates that are more befitting of an Internet company.

Analysts quoted in this story do not own shares of IAC/InterActive, and their firms have no investment banking ties with the company. The reporter of this story owns shares of Time Warner through his company's 401(k) plan. |

|