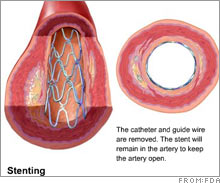

Drug-coated stent market stallsThe market for drug-coated stents, dominated by J&J and Boston Scientific, is getting squeezed by increased competition and reports of health risks.NEW YORK (CNNMoney.com) -- Growth in the relatively new, $5 billion worldwide market for the drug-coated stents might have already peaked. The stent industry -- estimated at more than $3 billion in the U.S. - is dominated by Johnson & Johnson's (down $0.11 to $65.95, Charts) Cypher stent and Boston Scientific's (down $0.23 to $16.71, Charts) Taxus stent. Stents are used to open clogged arteries in heart disease patients.

On Friday, experts from the Food and Drug Administration took a good, hard look at the use of these drug-coated stents in patients who don't meet the FDA's eligibility criteria, but were divided as to what to do about it. These higher-risk patients are considered "off-label" stent users, and the panel voters were conflicted as to whether the change the FDA label to include them, according to Reuters. The chairman of the expert panel said that pre-market studies on the stents should be larger and longer, according to Reuters, and said that off-label use can lead to complications. The FDA vote on the safety of the off-label use of these stents is non-binding, but the agency usually follows the advice of its experts when making a decision, which comes later. Given that this decision was indecisive, it's hard to say what will happen with the label, which outlines risks and side effects. Recent reports have blamed the drug-coated mesh stents for an increased risk of blood clots, which can cause heart attacks. But on Thursday, an FDA panel voted that the benefit of drug-coated stents outweighs the risk in the low-risk patients who meet the criteria of the FDA label. But regardless of the FDA's deliberations, the stent market may have reached its capacity, analysts say. Heart disease is the number one killer in America, and the industry devoted to its treatment and prevention totals $85 billion, according to some estimates. But despite this, the market for stents is believed to be limited by their possible health risks and an increasingly competitive market which will drive down prices. Separately from this week's panel meetings, the FDA is expected to decide next year on whether to approve drug-coated stents from Medtronic (down $0.10 to $53.43, Charts) and Abbott Laboratories (down $0.08 to $47.96, Charts), analysts say. The first drug-coated stents were approved in 2003. "We could expect prices to come down [as a result]," said Tao Levy, analyst for Deutsche Bank North America, noting that the stent market's revenues are already flat. Recent independent reports seem to favor the older, bare-metal stents over the newer, drug-coated mesh stents. "There was data over the last couple of months which pointed to the risks of off-label [use of drug-coated stents] and that's why we're seeing the contraction," said Jason Wittes, analyst for Leerink Swann, who said the new data concerning risks has already caused the market share for drug-coated stents to drop below 80 percent. Bare metal stents make up the rest of that market. "The market's going to stay huge," said Wittes, "it's just a question of growth, and growth coming down is not a good thing." The analysts interviewed for this story do not own shares of company stocks that they discussed. Deutsche Bank owns securities of J&J, Boston Scientific and Medtronic. Leerink makes a market in Boston Scientific, Medtronic and the J&J subsidiary Conor Systems. |

|