Apple says options probe clears JobsThe iPod maker restates earnings and says CEO Steve Jobs was aware of some options backdating, but he was not involved with any other wrongdoing; stock surges on the news.NEW YORK (CNNMoney.com) -- Apple Computer disclosed in a regulatory filing Friday that Chief Executive Officer Steve Jobs was aware that some stock options granted to him and other executives at Apple between 1997 and 2002 were backdated and that the company was restating financial results for the past few years as a result of the backdating. But the maker of the popular iPod also said that Jobs did not financially benefit from the options and added that a special committee that investigated the options-granting practices at Apple found no wrongdoing by Jobs or other current managers.

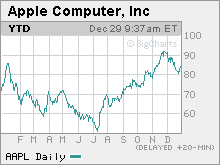

Shares of Apple (Charts) surged nearly 4 percent in early morning trading on the Nasdaq as investors appeared to bet that Jobs would not be forced to step down from Apple as a result of the options problems. In the filing, Apple also conceded that a board meeting in 2001 in which a grant of 7.5 million shares for Jobs was said to be approved never actually took place, which was first reported by the Financial Times. But Apple also cleared Jobs and other current managers of any wrongdoing regarding this matter. Jobs did not financially benefit from the options in question since he never exercised them, the company said. Apple said in its filing that it would restate earnings by a total of $84 million after tax, including $4 million and $7 million in fiscal years 2006 and 2005, to reflect stock-based compensation expenses for the backdated options. The company added that it has informed the Securities and Exchange Commission and the U.S. Attorney's Office of the results. "The special committee, its independent counsel and forensic accountants have performed an exhaustive investigation of Apple's stock option-granting practices," said former U.S. Vice President Al Gore, chair of the special committee, and Jerome York, chair of Apple's Audit and Finance Committee in a joint statement. "The board of directors is confident that the company has corrected the problems that led to the restatement, and it has complete confidence in Steve Jobs and the senior management team." Apple is one of many companies that have come under fire this year for so-called options backdating - manipulating the dates of options grants to boost their value. Other well-known tech firms, including Broadcom (Charts), Novell (Charts), McAfee (Charts) and CNET (Charts), have been caught up in options backdating woes as well as non-tech companies such, as insurer UnitedHealth Group (Charts). The filing caps a tumultuous week for Apple. Shares dipped sharply Wednesday morning after an online legal publication, The Recorder, reported that Jobs has already hired a lawyer to represent him in the event of any federal probe against him or Apple. The stock later rallied and finished a penny higher on Wednesday. The stock dipped nearly 1 percent Thursday due to the report from the Financial Times. Executives from several other companies that were found to have backdated options, including CNET, UnitedHealth, KB Home and Monster Worldwide, have stepped down as a result of the options mess. That led to fears that Jobs could also become a casualty of the backdating scandal. And Apple, more so than many other companies, is a firm that is widely associated in investors' minds with its CEO. Jobs, who co-founded Apple, left the company in the mid-1980s and Apple hit a rough patch shortly thereafter. Jobs returned in 1996 and took over as interim CEO a year later. Since then, he has been widely credited with making the company relevant again with products such as its iMac computer and the ubiquitous iPod media player and iTunes online store. But despite the fact that Jobs' name had surfaced more prominently in the most recent accounts of Apple's options problems, several Wall Street analysts said before the filing Friday that they thought Jobs would be exonerated. "Any time a CEO is at risk of being, for lack of a better word, forcibly removed, then investors should be concerned. But do I believe that Steve Jobs' job is at risk? That's an unequivocal no," said Jonathan Hoopes, an analyst with ThinkEquity Partners. Hoopes added that he did not think that there was much in the way of significant new disclosures about Apple in the past few days and blamed the sell-off on the inexperienced traders working the holiday week. SEC crackdown? Another analyst wrote in a report Thursday that since the options backdating problems have affected so many companies, it's unlikely that Jobs will get singled out by the SEC for any wrongdoing. "Our sources estimate that options backdating is a widespread and commonplace problem in the Fortune 500, affecting potentially as many as 30-35 percent of companies. Given the widespread nature, we doubt the SEC and Department of Justice will pursue a broad 'witch hunt' forcing key executives to step down that would undermine the recovery of the U.S. economy," wrote American Technology Research analyst Shaw Wu. The SEC has not commented as to whether or not it is looking into Apple's options practices. "Not to sound like conspiracy theorists, but we do not believe it makes sense for the U.S. government to nail AAPL and Steve Jobs, one of the most respected American companies and businessmen of the past 100 years," Wu added. Shebly Seyrafi, an analyst with Caris & Co., agreed that unless Jobs was found to be directly responsible for approving any misrepresentation of company records, then it's unlikely that he will need to resign. "The possible falsification of documents for Steve's compensation package is disturbing, but we'll see how out of hand this gets. I think the allegations would have to get out of proportion for Jobs to step down," he said. Analysts quoted in this story do not own shares of Apple and their firms have no investment banking relationships with the company. |

Sponsors

|