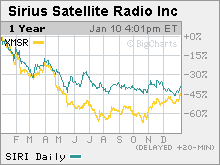

Sirius-XM merger makes senseSirius CEO Mel Karmazin reiterates that consolidation in the satellite radio industry could happen, defends Howard Stern bonus.NEW YORK (CNNMoney.com) -- The chief executive officer of Sirius Satellite Radio told investors Wednesday that he would be open to a combination with his company's top rival, XM Satellite Radio. Mel Karmazin, speaking at Citigroup's annual entertainment, media and telecommunications conference in Las Vegas, said that a merger between Sirius (Charts) and XM (Charts) could be in the best interests of both companies.

"One way you can create shareholder value is through consolidation, particularly in a fragmented industry like radio," he said. "Conceptually a deal makes sense and you could add value from synergies." Speculation has run rampant on Wall Street about a possible deal, and that has helped to lift the stock prices of both companies in recent weeks. Shares of Sirius gained more than 7 percent Wednesday, while XM's stock rose more than 10 percent. But both companies, although rapidly growing, have continued to lose money despite strong revenue and subscriber growth. Both companies offer paid subscription services that feature a variety of commercial-free music stations, as well as talk and sports channels that have ads. But some have argued that it would be better for the industry if the two companies did not have to compete against each other for subscribers. Sirius recently announced that it had surpassed the 6 million-subscriber mark. Shock jock Howard Stern, who hosts a show on Sirius, has been widely credited for much of Sirius's success. As such, Sirius announced on Tuesday that Stern received a $82.9 million bonus (payable in Sirius stock). That's on top of the five-year, $500 million deal Stern signed in 2004 to join Sirius. Karmazin, who worked with Stern when they were both at CBS (Charts), which was then a part of Viacom (Charts), defended the bonus and said that, even though he was not yet at Sirius when Stern signed his contract, he would have authorized a similar deal for Stern. He said that when Stern joined Sirius, Wall Street was expecting that Sirius would end 2006 with 3.5 million subscribers, so it's clear that Stern was paying off for the company. He added that Stern has more subscriber-based bonuses that could be triggered later on in his contract. "Howard got a bonus for exceeding the consensus subscriber number from Wall Street by more than 2 million," Karmazin said. "In all candor, I hope he hits all of his milestones." Karmazin would not comment on subscriber guidance or revenue guidance for 2007. But he did say that he expected to generate strong growth through sales of radios in retailers like Wal-Mart (Charts) as well as through deals to have radios preinstalled with auto manufacturers such as Ford (Charts) and DaimlerChrysler (Charts). As for competition, Karmazin conceded that XM is a tough rival and that traditional radio companies are also a formidable challenger. But he dismissed concerns that radio would be supplanted by Apple's (Charts) iPod or other mobile music devices. "Competition is not new. There always has been a threat to radio in the car," he said. "I remember when people first put an 8-track in the car and people said that nobody would listen to radio. [IPods] are a really cool product and people love their iPods but there will always be a strong place for radio. Radio is more than just music." Traditional radio firms have struggled lately,though, as listeners have defected to alternative forms of entertainment such as satellite radio and the Internet. With that in mind, industry leader Clear Channel Communications agreed to sell out to a group of private equity firms. And CBS agreed to sell several radio stations in smaller markets last year. CBS's CEO Les Moonves, who spoke at the Citigroup conference after Karmazin, conceded that CBS's radio business had a rough year in 2006, mainly owing to the fact that Stern defected from CBS to Sirius. "We lost the guy I'm not allowed to legally talk about," Moonves quipped, joking about a lawsuit that CBS filed against Stern in February 2006. CBS alleged that Stern violated his contract with CBS by promoting his upcoming Sirius show when he was still an employee of CBS. Stern and CBS settled the litigation in May, with Sirius agreeing to pay CBS $2 million in return for the rights to Stern's master tapes of his old shows. |

|