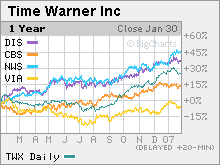

Good times for Time WarnerNo. 1 media company posts higher net, sets 2007 guidance mostly in line with forecasts, but stock falls modestly.NEW YORK (CNNMoney.com) -- Time Warner Inc., the world's biggest media company, capped off a roller coaster 2006 with fourth-quarter results Wednesday that were in line with most forecasts on Wall Street. Time Warner (Charts), which owns the second-largest cable company, the Warner Bros. movie studio, AOL and cable networks such as CNN and TBS, posted revenue of $12.5 billion, up 8 percent from the same period in 2005 and matching Wall Street's consensus estimates, according to figures from Thomson First Call. (Time Warner also is the parent company of CNNMoney.com.)

The New York-based company reported a net profit of $1.75 billion, or 44 cents a share, up 34 percent from a year earlier. But after excluding a gain from the sale of AOL's Internet access business in Britain and France and other one-time items, earnings came in at 22 cents a share, down from a comparable figure of 23 cents in the prior year but matching expectations. For the full year, Time Warner posted sales of $44.2 billion, up 4 percent from a year ago, and adjusted earnings per share of 81 cents, up 13 percent from 2005. Time Warner also issued 2007 guidance that appeared to be roughly in line with Wall Street was expecting. The company said earnings per share, before the effect of discontinued operations and accounting changes, should be $1 per share. Wall Street had been forecasting $1.02 per share. But in a research note on Wednesday morning, Bear Stearns analyst Spencer Wang pointed out that since Time Warner's earnings estimate includes a 10-cent per share gain from the AOL asset sales, Time Warner appears to be predicting that earnings will come in at just 90 cents per share. Wang called Time Warner's guidance "conservative." Time Warner also said that adjusted operating income before depreciation and amortization (OIBDA), a key metric of profitability that analysts look at, should grow in the mid-to-high teen percentage from 2006's level of $11.1 billion. Analysts are currently predicting that adjusted OIBDA for 2007 would come in at $13.1 billion, an increase of 18 percent. "We expect 2007 to be another superb year for Time Warner. Our businesses are well positioned to generate strong operating and financial performances," said Time Warner chairman and chief executive officer Dick Parsons in a statement. The company did not give specific first-quarter guidance. But during a conference call with analysts, Time Warner chief financial officer Wayne Pace warned that the company faces difficult comparisons to the first quarter of 2006. Analysts are predicting that Time Warner will report sales of $11.2 billion in the quarter and earnings of 22 cents per share. Shares of Time Warner fell about 1 percent in early morning trading on the New York Stock Exchange Wednesday . Time Warner posted healthy gains in revenue and operating profit in its cable and television networks businesses in the fourth quarter. Cable was particularly strong with sales up 58 percent and operating profits increasing by 26 percent in the quarter. During a conference call with analysts, Parsons said Time Warner Cable planned to launch several new products in 2007, including commercial phone service for small businesses and wireless phone services. Revenue at AOL slid in the quarter but operating profit surged, mainly due to the European asset sales. Revenue at Time Warner's magazine publishing division slid slightly although operating profit rose 6 percent. And the company's movie studio finished a tough 2006 with a dismal fourth quarter. Sales fell 15 percent and operating profit plummeted 48 percent. The unit faced tough comparisons to 2005 and several of Time Warner's high profile film releases underwhelmed at the box office. But Morris Mark, president of Mark Asset Management, a New York-based hedge fund that owns 1 million shares of Time Warner, said that the film division could bounce back in 2007 thanks to a strong slate of summer films, which include the fifth movie in the "Harry Potter" franchise and "Ocean's Thirteen," the latest in the crime caper series starring George Clooney and Brad Pitt. Last year was a tumultuous one overall for Time Warner. The company fended off calls for a break up from activist shareholder Carl Icahn. But Time Warner did agree to some of his plans. Most notably, Time Warner agreed to boost its stock buyback program to $20 billion, a program that the company said Wednesday it expects to complete in the first half of this year. Time Warner also announced a drastic overhaul of its AOL unit, which has been steadily losing subscribers over the past few years. The company said it would stop charging broadband customers access fees in the hopes of driving more traffic to AOL sites, and hence capitalize on the boom in online advertising that has lifted the fortunes of Internet search leader Google (Charts). During the conference call, Parsons said AOL's ad revenue grew 49 percent in the fourth quarter and that AOL appeared to be taking market share from other online sites for the first time in years. Mark said this was very encouraging for Time Warner. "The quarter was really strong in the areas you'd expect, particularly AOL advertising. The new program with AOL seems to be working. They are getting more users and that's the key thing," he said. In addition to the AOL asset sales, Time Warner also shed its book division last year and announced it would sell 18 of its magazines in its struggling Time Inc. unit (Swedish publisher Bonnier agreed to buy them this month). During the conference call, Time Warner president and chief operating officer Jeff Bewkes said that he expected the publishing unit to report profit growth in 2007 and that there probably would not be any other significant changes at the division following a recent round of layoffs and management changes. Time Warner also completed its joint purchase of the bankrupt cable company Adelphia with cable industry leader Comcast (Charts). And now that the Adelphia deal is closed, shares of Time Warner Cable are expected to start trading as a separate entity sometime in the next few weeks. Time Warner will retain majority control of Time Warner Cable but shares owned by Adelphia bondholders could hit the public markets this month. They are already trading on a so-called when-issued basis. During the call, Parsons said that even though the Adelphia bankruptcy reorganization plan has been approved by a judge, another judge has temporarily blocked it . As a result, Parsons said it was uncertain when Time Warner Cable shares would officially begin trading, and that the company is still considering taking Time Warner Cable public through a traditional initial public offering route. Diane Jaffee, senior portfolio manager with the TCW Diversified Value fund, which owns Time Warner, called the Adelphia transaction a "brilliant move" and said that the deal should help boost Time Warner Cable's operating profit margins. She added that her firm is considering buying shares of Time Warner Cable for other portfolios once it is publicly traded. Parsons also said during the call that Time Warner is in continued talks with Liberty Media, the media company controlled by mogul John Malone, about swapping some of Liberty's assets in exchange for the stake in Time Warner that Liberty owns. Shares of Time Warner rose nearly 25 percent last year, outperforming media rivals CBS (Charts) and Viacom (Charts). But the stock lagged the performance of media firms News Corp. (Charts) and Walt Disney (Charts) as well as Comcast. "We are far from satisfied," Parsons said about the stock's recent run. "For us the fundamental task is to build shareholder value." Bear Stearns' Wang does not own shares of Time Warner but his firm has done investment banking for the company. The reporter of this story owns shares of Time Warner through his company's 401(k) plan. |

Sponsors

|