Wall Street ready for a Time Warner shuffleTime Warner's stock price is up, and Carl Icahn has moved on to other targets. Now some think it is time for the media giant to prepare for life after Dick Parsons.NEW YORK (CNNMoney.com) -- It's been a year since media giant Time Warner and activist shareholder Carl Icahn settled their differences. Icahn dropped his attempt to take over control of the company on February 17, 2006. And although Time Warner (Charts) Chairman and Chief Executive Officer Dick Parsons did not agree to Icahn's demands to break up Time Warner into four separate companies, Icahn is clearly a happier shareholder now than he was at this time a year ago.

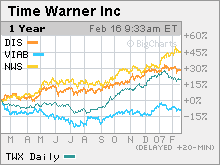

Icahn has gotten much of what he wanted since he and investment bank Lazard proposed the breakup plan for Time Warner, which owns CNN and CNNMoney.com, last February. In the past twelve months, Time Warner agreed to boost its stock buyback plan to $20 billion, succeeded in completing its purchase of assets from bankrupt cable provider Adelphia and set up a separately traded stock for its Time Warner Cable division and has launched a new strategy for its much-maligned AOL Internet unit that relies less on subscriptions and more on online advertising. And probably most important for Icahn, Time Warner's stock, which was trading at around $18 a share this time a year ago, is now trading at $21.65 a share, a more than 20 percent increase. In fact, Icahn cashed in on some of his investment in Time Warner late last year. Icahn disclosed in regulatory filings Wednesday that he and his firm Icahn Management now own 25 million shares of Time Warner as of December 31, down from about 68.7 million shares as of the end of the third quarter of last year. Icahn no longer seems to be as interested in agitating for major changes at Time Warner, having moved on to investments in other companies such as Motorola (Charts), auto parts supplier Lear (Charts) and paper products company Temple-Inland (Charts). Keith Cocozza, a spokesman for Time Warner, said the company had no comment on Icahn reducing his stake in Time Warner. But now that Icahn is no longer a thorn in the side of Time Warner's management, some Time Warner investors and analysts are starting to wonder whether it is time for Parsons to announce that he is getting ready to hand over the reins to president and chief operating officer Jeff Bewkes, a veteran executive at the company who is widely expected to be named Parsons's successor. "The Icahn situation was resolved very successfully from the view of the company and shareholders. We're very happy. And the Adelphia deal, which I think had been a major weight on the stock, finally got concluded," said Larry Haverty, a fund manager with GAMCO Investors, a money management firm that owns 12.2 million shares of Time Warner. "Dick Parsons has laid the groundwork for an orderly transition. It's not at all unclear what's going to happen. The only thing is when, in fact, it's going to happen," Haverty added. According to company filings with the Securities and Exchange Commission, Parsons' contract with Time Warner runs through May 15, 2008. "Dick Parsons will be chairman and CEO at least until the end of his contract," said Cocozza. But last month, Bewkes was elected to Time Warner's board of directors, a move that some believed is a precursor to him being named CEO in the not-so-distant future. "Being named to the board certainly helps Bewkes' chances of becoming CEO. That works in his favor," said Peter Jankovskis, director of research with OakBrook Investments, a Lisle, Ill.-based money management firm that owns 341,800 shares of Time Warner. Parsons took over as Time Warner's CEO in 2002 and was named chairman a year later. At the time, many on Wall Street hoped that he would come up with a plan to get the struggling AOL unit back on track as well as make the company less complicated to understand in the eyes of investors. That job, some shareholders say, has been accomplished. So it could be time for Bewkes, who has more of a traditional media background, to lead the company. "Bewkes has demonstrated his ability to run all the businesses and be a hands-on operator. Parsons has been great at what he has done and was needed to stabilize the ship and right the course after the AOL acquisition," said David Carr, co-manager of the Oak Value fund, which owns about 385,000 shares of Time Warner. "But the Street and most investors would prefer to have an operator at the helm at a time when you need someone deciding how to strategically allocate capital. Bewkes would be the right candidate for that," Carr added. Bewkes has been with Time Warner since 1986, moving up in the ranks from chief financial officer of the HBO cable channel to a role as chairman of Time Warner's cable networks and film and TV entertainment studios. He was promoted to the number two spot behind Parsons, which gave him oversight over all of Time Warner's businesses, in December 2005. "Bewkes has already been influential and he will be even more so over the next couple of months. It's all set up. It would be a big surprise if Bewkes wouldn't be named CEO," said Harold "Hal" Vogel, a veteran media analyst and chief executive officer of Vogel Capital Management, which runs a venture capital fund and hedge fund as well as a management consulting firm. Vogel's firm is not an investor in Time Warner. The ascension of Bewkes to CEO would probably be welcomed by Icahn and other critics of the company as well. Frank Biondi, the veteran media executive Icahn picked to oversee the break up of Time Warner if his attempt to take control of the company succeeded, conceded last February that he wanted Bewkes to stay on with Time Warner and lead the cable networks and film and television studios. Biondi was fired from two high profile media jobs, the top spots at Viacom (Charts) and Universal Studios, in the 1990s following a string of disappointing film releases at both companies. Vogel said he did not expect Bewkes to take over before Parsons' contract runs out. But some think the company's board could announce within the next few months, possibly as early as Time Warner's next annual shareholder meeting in May, plans for Bewkes to take over in 2008. "Bewkes is a solid number two and most people expect he can step right in. He's been actively groomed for the top position sooner rather than later," said Tuna Amobi, an equity analyst with Standard & Poor's. "Most people seem to think that Parsons is doing a fine job. But his contract is up next year and I'm not sure continuing to run Time Warner is what he wants to do for the next phase of his life." To that end, several New York-based newspapers and magazines have speculated that Parsons may want to run for mayor of New York City in 2009. But Amobi added that Parsons still has some unfinished business at Time Warner. Shares of Time Warner have outperformed Viacom over the past year but have lagged the performance of media rivals Walt Disney (Charts) and News Corp (Charts). And the AOL transition is only beginning, Amobi said. He added that the uncertainty about AOL over the next few years is the main reason why he still rates the stock a "neutral." Even though AOL reported advertising growth of 49 percent in the fourth quarter, the company's overall sales and adjusted operating income before depreciation and amortization, a key measure of profitability, both fell during the quarter. As such, Vogel said that even though calls for a Time Warner breakup have ebbed thanks to the stock's recent rise, talks about selling more assets, or even an outright split, could return to the table if AOL or other poorly performing businesses, such as Time Warner's magazine publishing division, do not show more signs of improvement by the time Parsons is ready to step aside. "Bewkes' management style will be different than Parsons'," Vogel said. "And he will have a big strategic challenge ahead of him. Is Time Warner better off partly broken up or does it just go on the way it has been going?" Analysts quoted in this story do not own shares of Time Warner, and their firms have no investment banking relationships with the company. The reporter of this story owns shares of Time Warner through his company's 401(k) plan. |

Sponsors

|