Is BitTorrent the next big IPO?The file sharing service, known for making it easy to illegally download videos, has made nice with Hollywood. Now is it wooing Wall Street?NEW YORK (CNNMoney.com) -- Several Internet companies have gone public since Google did back in 2004. But none has made the kind of splash that Google (Charts) has. Could peer-to-peer file sharing service BitTorrent change this and be the next big dot-com IPO?

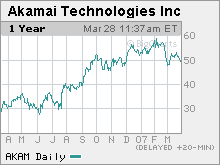

BitTorrent develops free software that lets people download and share videos, music or other files that have already been downloaded on other computers using BitTorrent's program. The company says more than 135 million people have downloaded its software, and more than 30 million active users. The software is designed so that the more people there are downloading a certain file, the faster it is to retrieve it. That's key for big files like movies, which can often take more than an hour to download. So depending on the type of broadband connection a person has, the company says its software can cut the download time for a large file by anywhere between 10 percent and 50 percent. "When downloading a movie, it should be faster than a pizza delivery. That's a safe rule of thumb with us," said Ashwin Navin, the president, COO and co-founder of BitTorrent. To be sure, there are people who use BitTorrent to illegally download copyrighted videos. For this reason, there were some in the media and tech worlds who used to think that BitTorrent could wind up becoming the next Napster (as in the original privately held source for free, albeit pirated, music) or Grokster and would wind up getting shut down or sued into oblivion. But BitTorrent has made nice with Hollywood. Last month, the company announced something called the BitTorrent Entertainment Network, a site that lets users legally download videos (for a fee) from studios such as News Corp.'s (Charts) 20th Century Fox, Lionsgate, Time Warner's (Charts) Warner Bros. and MGM, which is owned by a consortium that includes Sony and Comcast. (Time Warner also owns CNNMoney.com.) What's more, MTV Networks and Paramount Pictures are also partners in the BitTorrent site. It's worth nothing that those studios are owned by Viacom (Charts), the entertainment giant that is suing Google and its subsidiary YouTube for copyright infringement. Navin said his company always had the intention of working with big media firms in order to avoid lawsuits. "Getting validation from Hollywood was important. Our approach has always been constructive," he said. "Tech companies really need to better understand how entertainment companies work. There clearly is going to need to be some hand holding early on and the trick is going to be finding common ground. Litigation slows down everyone's ability to move forward." And the fact that BitTorrent has gone legit, so to speak, is crucial, analysts said. "Companies that have swum on the wrong side of the legal current have generally been proven to be short-lived," said Mark Kirstein, an analyst covering multimedia and content services at iSuppli, an independent market research firm focusing on technology and media. "Any company that can make that transition to a legitimate business model, especially when they have a strong following, should be in good shape." Navin would not disclose how much revenue BitTorrent is generating but he said that it will receive a cut of fees and advertising sales generated from the new BitTorrent Entertainment Network. In addition, he said BitTorrent is going to unveil a corporate version of its peer-to-peer delivery network, dubbed BitTorrent DNA, sometime during the second quarter of this year. He said some companies are already testing it but declined to name them. Since peer-to-peer file sharing cuts down on costs of maintaining central servers and also delivers files faster than typical downloads, Navin said he's confident that BitTorrent will soon have a valuable new revenue stream from licensing its technology. And it's the BitTorrent DNA product, more so than the site that people can go to download videos, which has people excited about BitTorrent's future. Setting up a destination where people can go to buy videos or watch them with ads is a highly competitive business. In addition to YouTube and scores of other video sharing and download services like Apple's (Charts) iTunes and Amazon's (Charts) Unbox, big media firms - including some BitTorrent partners - are also staking their claim online. Last week, News Corp. and GE (Charts)-owned NBC Universal announced that they were forming a joint venture to showcase their content. With this in mind, several analysts said that BitTorrent's peer-to-peer network is the more lucrative business. "As popular as content is, it's a difficult marketplace to break into. But if you are a distribution platform, you can benefit from all the people jumping into broadband video," said Anton Denissov, an analyst focusing on broadband video with Yankee Group, an independent research firm in Boston. "Distribution deals will be springing up like mushrooms after a spring shower." So what about BitTorrent's chances for going public? The company has high profile venture capital backing -- it completed a $20 million round in December from VC firms Accel and DCM. Accel has invested in RealNetworks, popular social networking site Facebook and Groove Networks, a software developer acquired by Microsoft (Charts). DCM was an investor in About.com, which was bought by New York Times Company (Charts), Cisco (Charts) competitor Foundry Networks, and Clearwire (Charts), the wireless service provider that recently went public. William Wilson, an analyst with MorningNotes.com, a Boulder, Colo.-based independent research firm that tracks IPOs and secondary offerings, points out that another content delivery company, Limelight Networks, filed to go public earlier this month. If that deal performs well, he said a BitTorrent IPO could quickly follow. "If BitTorrent went public, it would be a high interest deal. But it would probably be in the interest of BitTorrent to wait for the Limelight offering to set the bar," Wilson said. But it seems safe to expect that Limelight could have a solid offering considering that one of its top competitors, Akamai Technologies (Charts), is doing extremely well. Analysts expect Akamai's sales to increase 45 percent this year and profits are expected to jump 48 percent. The stock has increased more than 75 percent in the past 52-weeks. And one analyst thinks that BitTorrent could be a tough competitor to both Akamai and Limelight because of the efficiency that comes from the nature of its peer-to-peer system. "BitTorrent could be the evolutionary successor to Akamai in video content delivery So it could be a potential IPO. It has money, strong alliances and superior technology," said Phil Leigh, an analyst with Inside Digital Media, an independent research firm based in Tampa. Navin was coy about the company's intentions. But he conceded that BitTorrent was paying attention to Akamai's Wall Street success and Limelight's IPO and that as a venture-backed company, an IPO or sale for BitTorrent can't be ruled out.

The reporter of this story owns shares of Time Warner through his company's 401(k) plan. |

| |||||||||