'Torture porn' helps Lionsgate roarThanks to horror hits 'Saw' and 'Hostel,' Lionsgate has been one of the hottest media stocks. Can the studio keep impressing at the box office and on Wall Street?NEW YORK (CNNMoney.com) -- Media stocks have been on a tear for the past year. Investors have been entertained by strong box office results, relatively healthy advertising sales at cable networks and increased efforts by media firms to boost their online presence. But it might come as a surprise to media investors that one of the best performing stocks in the sector over the past year is not a media conglomerate.

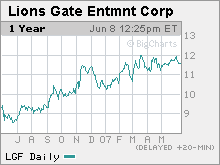

Shares of independent film and TV studio Lionsgate (Charts), the company behind "torture porn" horror franchises "Saw" and "Hostel," have outpaced the gains of all its bigger media rivals. Shares of Lionsgate have surged 24 percent in the past 12 months and are up nearly 9 percent year-to-date. By way of comparison, shares of media titans CBS (Charts, Fortune 500), Viacom (Charts, Fortune 500), News Corp (Charts, Fortune 500)., Walt Disney (Charts, Fortune 500) and Time Warner (Charts, Fortune 500) are up, on average, 17 percent over the past year and 1 percent so far in 2007. (Time Warner owns CNNMoney.com.) And with "Hostel: Part II," the sequel to the gruesome horror film about young Americans being maimed and tortured, hitting theaters on Friday, analysts see even bigger gains ahead for Lionsgate. The first "Hostel" film grossed $47.3 million at the U.S. box office last year, according to figures from movie industry tracking firm Box Office Mojo. That's a great return for Lionsgate considering the movie's production budget was just $4.8 million. Thomas Eagan, an analyst with Oppenheimer & Co., said he thinks "Hostel: Part II" could also gross out plenty of moviegoers. He's predicting that the movie will debut this weekend with about $15 million or so at the box office and go on to about $40 million in total U.S. ticket sales. Eagan said he's slightly concerned that some investors may have unrealistic hopes for the movie. He said some box office analysts have been forecasting a $20 million opening weekend and total box office run of $50 million to $55 million. That might not be attainable, Eagan argues, since the movie is facing tough competition from Time Warner's "Ocean's 13," which also opens this weekend, as well as summer blockbusters like Disney's "Pirates of the Caribbean: At World's End" and "Knocked Up," the romantic comedy from GE's (Charts, Fortune 500) Universal Studios. "I'm a little concerned about lofty expectations. The film will do well and will most likely generate a profit. But if it doesn't hit $20 million this weekend, the stock could pull back," Eagan said. Typically, Lionsgate has kept its horror movies out of the widely crowded summer season. The "Saw" movies have all debuted around Halloween while last year's "Hostel" came out in the first week of January. So competition wasn't as fierce. But Michael Kelman, an analyst with Susquehanna Financial Group, said "Hostel: Part II" could do surprisingly well since there are lots of horror movie fans out there who don't have much else to see during a summer of action sequels. "This is a slightly different time period for a film like this but it could do well because it's counterprogramming," Kelman said. Analysts added that Lionsgate should also benefit from a new $400 million film fund that it recently created that will allow the company to produce more movies. Last month, Lionsgate said it would contribute about $200 million to the fund and that outside investors, led by Goldman Sachs (Charts, Fortune 500) would pony up another $200 million. The fund will finance 23 films over the next three years, including "Bug," the Ashley Judd thriller that came out last month, "Good Luck, Chuck," a teen comedy featuring hot comedian Dane Cook and Jessica Alba, and "War," a martial arts film starring Jet Li and British action star Jason Statham. While the film fund will enable Lionsgate to release more movies, which presumably should boost the company's sales, there has been some confusion about the impact the fund will have on profits. Because Lionsgate will have to recognize all promotional and distribution costs for films financed by the fund once they are released, Lionsgate said last month when it reported its latest quarterly results that the company now expects to lose money this fiscal year, which ends in March, 2008. But Andy Nasr, an analyst who follows the company for Raymond James, said investors should not be concerned about short-term losses. He notes that Lionsgate should still be able to post healthy gains in free cash flow. What's more, Nasr adds that the movies should start contributing to earnings once they are released on DVD. So he thinks the company should return to profitability in its next fiscal year and that the creation of the fund was a smart move that will enable Lionsgate to produce more films without bearing all the financial burdens in the event of a flop. "Lionsgate is increasing its release slate only because of this partnership. Other investors are bearing half of the risk," Nasr said. Sure, this may also mean that Lionsgate won't fully take part in the profits generated from the films financed by the fund. But Nasr points out that the fund is not going to be used for future films in Lionsgate's hot franchises like "Saw" (a "Saw IV" is due out this October) as well as the popular movies from actor and writer Tyler Perry, who has had a string of hits for Lionsgate based on his popular Madea character. Nasr added that this could be Lionsgate's best year at the box office ever. In addition to the upcoming "Saw IV" "Good Luck, Chuck" and "War," Lionsgate will also be releasing a movie based on the Bratz line of dolls as well as "3:10 to Yuma," a Western starring Russell Crowe and Christian Bale. So Lionsgate still looks like a good long-term bet, analysts said, even though the stock could dip if the box office figures for "Hostel: Part II" don't live up to the lofty expectations. Analysts quoted in this story do not own shares of Lionsgate and their firms have not performed investment banking with the company. The reporter of this story owns shares of Time Warner through his company's 401(k) plan. |

Sponsors

|