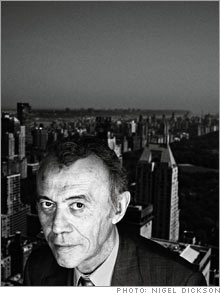

Eveillard: A value maestro's encoreFor almost 30 years, global fund manager Jean-Marie Eveillard made a lot of money bucking trends. After a two-year break, he's back.(Fortune Magazine) -- As Jean-Marie Eveillard strolled the streets of Paris on the first night of this spring, coming out of retirement was the furthest thing from his mind. He and his wife had just enjoyed a performance of La Juive at Paris's Bastille opera house, followed by a late dinner. But on returning to their apartment, Eveillard was greeted by a half-dozen messages from his former employer, New York City's Arnhold & S. Bleichroeder Advisors. "They wanted to know if I could be back in the office on Monday," he recalls.

The 67-year-old Eveillard had been one of Wall Street's best value investors, leading Bleichroeder's First Eagle Global fund to a 15.8% average annual return - compared with 13.7% for the S&P 500 - over his 26 years at the helm, according to Morningstar. (The fund, launched as SoGen International, was renamed seven years ago when Bleichroeder bought it from Soci�t� G�n�rale.) Eveillard retired in 2004, turning the fund over to longtime prot�g� Charles de Vaulx. And de Vaulx kept the ball rolling, with 14.9% returns in 2005 and 20.5% last year. Then de Vaulx quit abruptly in March. (Contacted by Fortune Magazine, De Vaulx declined to discuss his reasons for leaving.) Soon after, Eveillard agreed to retake the reins temporarily and boarded a plane for New York. In addition to Global, with $22.1 billion in assets, Eveillard is back running three other First Eagle funds - $1.1 billion Gold, $11.9 billion Overseas, and $677 million U.S. Value. (Only U.S. Value is open to new investors.) He agreed to stay on full-time for a year, after which associate portfolio manager Charles de Lardemelle will take over. Eveillard says he came out of retirement to protect funds that "were a little bit my babies." He can be very protective. Global lost money only twice during his tenure: a trifling 1.3% in 1990 and 0.26% in 1998. And while Eveillard underperformed the market during the late 1990s, fans see that as less a failure than a show of character. "In the late 1990s - when I think his fund shrank to half its former size because he was not buying the crazy tech stocks that were doing so well - he stuck with his strategy," says Bruce Greenwald, a finance professor at Columbia Business School, where Eveillard has lectured. "That really made his reputation later on." Indeed, Global was a post-crash standout, returning 10.5% in both 2001 and 2002, 38% in 2003, and 18.7% in 2004. In his first major interview since coming back, Eveillard made it clear that his two-year hiatus didn't do anything to soften his contrarian streak. Fortune: Did Charles de Vaulx ever tell you why he quit? It's still a puzzle to me. He called me a week after, but it was a conversation where he said little and I didn't want to pry. But it had nothing to do with the returns of the fund. It was entirely voluntary. I think he left in a huff for reasons that escape me. Fortune: Were you managing any money over the past two years - your own portfolio, perhaps? Shortly after I retired, a friend of mine who's in the business said to me, "Ah, well now you'll have plenty of time to run your own portfolio." I told him no. I kept my money in my funds - or what used to be my funds - because it would not have shown great confidence in Charles if I had taken my money off the table. Also, one thing about Americans - something I think is very positive - is there's this idea that God did not put us on this earth to do nothing. No matter your age. Whereas Europeans believe that once you retire, there is nothing wrong with doing nothing. I was reading the financial newspapers, I helped teach a course on value investing at Columbia Business School, but otherwise I did not have a very active retirement. Fortune: So what were you doing? Are you familiar with Sudoku? [Laughs.] My wife and I have been collecting drawings for a few years, so we went to auctions. I traveled. Fortune: Today's art market must be tough to swallow for someone with a value mindset like yours. Whether you're investing in art or in securities, no one should confuse value and price. Today there is lots of contemporary art that sells for tens of millions of dollars and is not very good. And there is also sometimes very good art that sells for very little. Fortune: Anything that has surprised you upon your return to the investing world? The stock market in the U.S. and outside the U.S. has been going up for four years, which usually does not present investors with a great many new opportunities. To paraphrase [value investing pioneer] Ben Graham, the markets seem high, they are high, and they are as high as they seem. Fortune: But you don't buy markets. No, we don't buy markets. We buy specific securities. But I see that lack of opportunity from the bottom up as well. Some of the stocks we own have gone up to the point that they're very close, if not above, what we consider their intrinsic value. And when we look at new names, new ideas, we seldom end up buying. Contrary to many mutual fund managers, we do not believe we have to be fully invested 100% of the time. Fortune: Morningstar puts your cash position at about 18%. Is that still accurate? Yeah, although we don't decide to be 5%, 10%, or 25% in cash. If we find enough investment opportunities, the cash will go down. Fortune: You pay a lot of attention to companies' tax rates. Why? Particularly in the U.S., I don't like companies with very low tax rates, because it's a sign either that the Internal Revenue Service will catch up with them someday or that the profits they report are overstated. The average corporate tax rate is 35%. Any company that has a tax rate of 15% or 20% looks suspicious to me. Fortune: I keep waiting for a brave contrarian fund manager to dive into homebuilder stocks. Any interest? Before I came back, Charles [de Vaulx] had one of the analysts look at it, but we didn't buy anything. I've always thought it was very hard to value homebuilding stocks. In normal times, the price/earnings ratio looks so low, but it's because it includes a lot of gains on land. So no, we're not looking at homebuilding stocks. I think there was a housing bubble, and as a consequence of the subprime meltdown, I think that housing is not about to recover anytime soon. Fortune: I'm guessing then that you aren't rushing to buy bank stocks either. No. We're at the tail end of a global credit boom. Financial stocks now account for 25% or 30% of the S&P, and the financial world has become almost as important as the real world of industry and commerce. Some excesses have appeared, subprime housing being the last though not the least. Private equity too. Fortune: Do you think the current buyout boom is going to end badly for all these private-equity firms? Of course. I think there are some private-equity firms that are fully aware of that, but, hey, they've got money to spend. I think the next question for private equity and hedge funds is going to be, "Where are the customers' yachts?" Fortune: The last time I interviewed you, four years ago, you were very bullish on gold. Since then gold prices have doubled, and yet you're still bullish, with 5% of your portfolio in gold bullion or mining stocks. Hasn't the run-up in gold prices tempered your enthusiasm? We look at it as insurance. The fact that the price is up means that the insurance premium has become more expensive. Two things that struck me when I came back several weeks ago - one, many of the stocks we owned are not particularly undervalued, at least outside Japan and South Korea. Second, there has been a terrific credit boom, and man, what happens when the credit cycle turns? The basic idea with gold is that under most circumstances in which the stock market goes down, it would be good for gold. Gold would provide a partial offset to the hit we would take in the equity portfolio. Fortune: Some gold fans are buying on the premise that rising demand for gold jewelry in the developing world will be good for commodity prices. Do you subscribe to that idea? When we started our gold fund in 1993 - which proved to be six or seven years too soon - I mistakenly thought that my downside was protected by the fact that jewelry demand was fairly vibrant. But I was wrong. I think gold moves up and down based on investment demand mostly. Fortune: What's so special about Japan and South Korea? We have less trouble finding stocks in those markets. For Korea, I think it's a result of the well-known "Korean discount," which I think is no longer justified. After the Asian crisis in 1997, what we found very interesting is that the Koreans changed their ways considerably. They were much better able to adapt than the Japanese - the government, the corporations, the people. They changed their ways for the better. [Korean stocks that Eveillard owns include Samsung, SK Telecom, and Lotte Confectionery Co.] Fortune: And Japan? I think there are opportunities, because before 2003 Japan went through a 13-year bear market. And in a 13-year bear market every stock - and I mean every one - gets buried. They were resurrected in 2003, 2004, and 2005, but I think that many opportunities remain. Fortune: You've been quoted a lot recently about Dow Jones, opining that the Wall Street Journal's publisher should accept Rupert Murdoch's buyout offer. [FORTUNE interviewed Eveillard in late May.] I'm not sure why [reporters] call me, because we were not one of the very large shareholders in Dow Jones (Charts). Though I am surprised we haven't gotten a call from the SEC, because we happened to buy over 100,000 shares on the day before the announcement [of Murdoch's offer]. We just felt that the intrinsic value was between $45 and $50 a share, which is why we were buyers in the low 30s. Fortune: Do you have any philosophical opposition to the dual share classes that so far have kept Dow Jones out of Murdoch's reach? Not really, because I'm not forced to buy it if I don't like the dual structure, which of course protects the [Bancroft] family. Anyway, we sold most of our stock in the mid-50s, which was way above what we thought the business was worth. And I think there is a genuine risk that the family will say no, in which case the stock goes back to $35. |

|