Search News

NEW YORK (CNNMoney.com) -- Is the Federal Reserve forever blowing bubbles?

With interest rates hovering at historic lows, some economists and investors fear the Fed's easy-money policy could create another asset bubble. But others don't see a need to hit the panic button just yet.

|

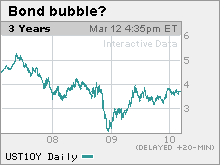

| While bond yields are off their recent low, they are still lower than normal, raising the risk of a bubble in bond prices, which move in the opposite direction than yields. |

Critics want the central bank to start hiking rates and withdrawing some of the trillions of dollars pumped into the system over the last few years to help spur U.S. economic activity.

Neither move is likely to happen at Tuesday's meeting of central bank policymakers.

But Fed watchers will be looking closely at the Fed statement for clues about its so-called exit strategy and any signs of bubble worries among the Federal Open Market Committee members who control monetary policy.

The Fed gets blamed for creating bubbles because when rates are low, money is cheap for investors. That can encourage excessive risk taking and drive up asset prices, as in the dot.com boom of the late 1990s or housing prices in the middle of the last decade.

"Easy money is a key ingredient of crazy bubbles," said Lakshman Achuthan, managing director of Economic Cycle Research Institute. "This is why observers have said the Fed is just blowing up bubbles."

Critics have argued the central bank has a duty to "pop" bubbles before they inflate too large and cause economic havoc. Fed officials have responded that it's difficult to foresee an asset bubble forming, and that monetary policy is not an effective tool for bubble bursting.

But that was before an extended period of easy money was followed by the massive bubble in home prices, which sparked a crisis in the global financial system and the worst economic downturn since the Great Depression.

Fed Chairman Ben Bernanke argued in a speech on Jan. 3 that the Fed's monetary policy was getting too much of the blame for the run-up in home prices.

Not all economists agree.

But the Fed seems more ready to acknowledge the risks of a bubble today than ever before.

In the minutes of its November meeting, policymakers worried that an extended period of low rates "could lead to excessive risk-taking in financial markets" -- economic-speak for the creation of bubbles.

The minutes didn't identify any potential bubbles, but experts have pointed to a series of inflated markets, including U.S. Treasurys, commodities such as gold and oil and even in U.S. stock markets, which have rebounded more than 60% since their low-point a year ago.

But is the fear of another asset bubble enough to spur the Fed to tighten economic policy and start pushing up rates?

Many economists are doubtful. They think the Fed is less concerned with bubbles than with spurring economic growth.

"I think bubbles are something the Fed needs to watch," said David Wyss, chief economist at Standard & Poor's. "But I don't see much evidence that is the dominant issue for the Fed compared to 10% unemployment and lack of sustainable growth."

The Fed's statements for the last year have predicted the fed funds rate will stay exceptionally low for "an extended period."

Wyss and others say they aren't convinced that the Fed has created any new bubbles during its current period of easy money.

They say that much of the run-up in prices of assets such as Treasurys and gold is due to investors' aversion to riskier assets, and not just the cheap and easy money.

"You're seeing evidence still of significant risk aversion in the markets," said Wyss, who points to historically high spreads between Treasury rates and junk bond rates.

During the bubble years, that spread fell to less than 3% -- an indication of excessive risk-taking that fed the boom in subprime mortgages and in turn, housing prices. When the crisis hit and credit markets froze, the spread pushed up above 17%. Today it's around 6%, or above the typical 5% pre-bubble level.

Plus, not every rise in an asset market indicates a bubble, even if prices do eventually turn lower.

"Anytime the price moves up, people call it a bubble and that's a misuse of the word," Wyss said.

Barry Ritholz, CEO and director of equity research at Fusion IQ, said that too many people have become obsessed with bubbles because of the problems caused by the bursting of the dot.com and housing bubbles.

"No one saw bubbles in 1999 or 2006, and then after missing the biggest bubbles in history, everyone is spotting bubbles," he said. "I'm always reluctant to fight the previous war."

But even those who don't think there's a bubble building aren't ready to dismiss the risk if the Fed keeps the cheap money flowing.

"We know from history that really cheap money encourages people to do really stupid things," said Ritholz. "But I see no evidence that the Federal Reserve has created any bubbles -- and here's the pregnant pause -- yet." ![]()

| Index | Last | Change | % Change |

|---|---|---|---|

| Dow | 32,627.97 | -234.33 | -0.71% |

| Nasdaq | 13,215.24 | 99.07 | 0.76% |

| S&P 500 | 3,913.10 | -2.36 | -0.06% |

| Treasuries | 1.73 | 0.00 | 0.12% |

| Company | Price | Change | % Change |

|---|---|---|---|

| Ford Motor Co | 8.29 | 0.05 | 0.61% |

| Advanced Micro Devic... | 54.59 | 0.70 | 1.30% |

| Cisco Systems Inc | 47.49 | -2.44 | -4.89% |

| General Electric Co | 13.00 | -0.16 | -1.22% |

| Kraft Heinz Co | 27.84 | -2.20 | -7.32% |

|

Bankrupt toy retailer tells bankruptcy court it is looking at possibly reviving the Toys 'R' Us and Babies 'R' Us brands. More |

Land O'Lakes CEO Beth Ford charts her career path, from her first job to becoming the first openly gay CEO at a Fortune 500 company in an interview with CNN's Boss Files. More |

Honda and General Motors are creating a new generation of fully autonomous vehicles. More |

In 1998, Ntsiki Biyela won a scholarship to study wine making. Now she's about to launch her own brand. More |

Whether you hedge inflation or look for a return that outpaces inflation, here's how to prepare. More |