Search News

NEW YORK (CNNMoney.com) -- They say March comes in like a lion and goes out like a lamb. But in this boring, steady-as-she goes market, the most appropriate animal to describe this month is the tortoise.

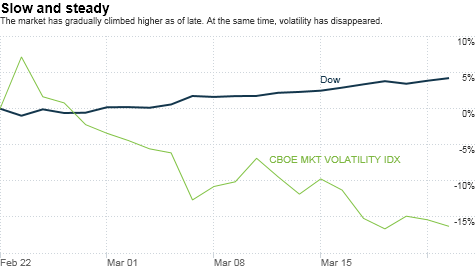

You might be surprised to hear that stocks are on a bona fide tear this month. The Dow is up 5.5% so far even though there have been only two triple-digit daily jumps: a 122 point gain on March 5 and today's rally.

The Dow has risen in 10 of the past 11 trading days and has gained ground in 14 of the 17 trading sessions in March. And the Dow's actually been the laggard of the major market barometers. The S&P 500 is up 6.3%, while the Nasdaq has shot up 7.9%.

At the same time, investors seem to be a lot less nervous about the economy, earnings and the political situation in Washington. Wall Street's so-called fear gauge, the CBOE Market Volatility Index -- or VIX (VIX) for short -- is hovering around a 52-week low.

This is a good sign, according to Kate Warne, market strategist with Edward Jones in St. Louis. She argues that it's better for the market to slowly churn upwards instead of moving higher on the back of monstrous one-day pops.

"It's easy to be distracted by the daily moves in the market. The lack of volatility helps investors focus more on the longer-term," she said.

It wasn't that long ago that stocks were getting whipsawed wildly due to worries about the housing and job markets and concerns about the impact of health care reform and a heavier dose of financial regulation.

But for the time being at least, fear has dissipated. What's interesting though is that hasn't been replaced by extreme optimism, but a begrudging sense of calm.

It's almost as if investors are buying stocks out of sheer boredom -- and that's not necessarily a bad thing.

"We're encouraged by this. Volatility is low. It's a slow, steady grind higher," said Ryan Detrick, senior technical strategist with Schaeffer's Investment Research in Cincinnati. "There's not a lot of volume. Investors aren't enthusiastically jumping in with both feet."

The good news there is that the market may not look overly expensive right now for investors that are coming to the rally a little late.

It's also worth pointing out that some of the market's blue chips, "boring" industrial companies that should do better as the economy improves like Boeing (BA, Fortune 500), Caterpillar (CAT, Fortune 500) and GE (GE, Fortune 500), are helping to propel the market higher. It's not just speculative financials such as Citigroup (C, Fortune 500) and AIG (AIG, Fortune 500) that are surging.

"When the market began to rally last year, the riskiest stocks moved the most. But industrials are the leading sector this year," Warne said. "There has been a shift toward quality as investors are paying attention to the global economic rebound."

Detrick said that it seems like professional money managers are buying stocks on the notion that the worst is over. But he said that the average investor is still sitting on the sidelines due to lingering doubts about whether the economy is really recovering.

That partly helps to explain why stocks are slowly moving up instead of exploding higher. The gains are limited as many smaller investors continue to look for other places to park their money.

"Individual investors are still shell-shocked. Many are putting their cash in bonds because they want safety. They want to know that their money is going to be there a year from now," Detrick said.

For this reason, he argues that stocks could continue to move higher. Investors that have been unwilling to buy stocks may finally start doing so again once there is concrete evidence that the economy, specifically the job market, is really turning around.

But some think that the rally could stall because there is no reason to think that the economy will improve enough to entice people back into the market.

"The market is probably where it ought to be. It may not go much higher," said Steven Kyle, professor of applied economics at Cornell University.

"The economy, because of stimulus and other factors, has stopped its free fall. But it is probably going to stagger along this year and that means low growth. It's nothing that people should feel good about," he added.

Still, unless there's a major negative shock to the economy, Warne thinks that the rally still has legs. The fact that the housing market is still weak is not a revelation. Neither is the fact that the unemployment rate remains stubbornly high.

"There are no big, new problems for investors to absorb. That's giving an edge to the optimists who think the economy is in recovery and that we should have stronger earnings later this year," she said.

- The opinions expressed in this commentary are solely those of Paul R. La Monica. ![]()

| Overnight Avg Rate | Latest | Change | Last Week |

|---|---|---|---|

| 30 yr fixed | 3.80% | 3.88% | |

| 15 yr fixed | 3.20% | 3.23% | |

| 5/1 ARM | 3.84% | 3.88% | |

| 30 yr refi | 3.82% | 3.93% | |

| 15 yr refi | 3.20% | 3.23% |

Today's featured rates:

| Index | Last | Change | % Change |

|---|---|---|---|

| Dow | 32,627.97 | -234.33 | -0.71% |

| Nasdaq | 13,215.24 | 99.07 | 0.76% |

| S&P 500 | 3,913.10 | -2.36 | -0.06% |

| Treasuries | 1.73 | 0.00 | 0.12% |

| Company | Price | Change | % Change |

|---|---|---|---|

| Ford Motor Co | 8.29 | 0.05 | 0.61% |

| Advanced Micro Devic... | 54.59 | 0.70 | 1.30% |

| Cisco Systems Inc | 47.49 | -2.44 | -4.89% |

| General Electric Co | 13.00 | -0.16 | -1.22% |

| Kraft Heinz Co | 27.84 | -2.20 | -7.32% |

|

Bankrupt toy retailer tells bankruptcy court it is looking at possibly reviving the Toys 'R' Us and Babies 'R' Us brands. More |

Land O'Lakes CEO Beth Ford charts her career path, from her first job to becoming the first openly gay CEO at a Fortune 500 company in an interview with CNN's Boss Files. More |

Honda and General Motors are creating a new generation of fully autonomous vehicles. More |

In 1998, Ntsiki Biyela won a scholarship to study wine making. Now she's about to launch her own brand. More |

Whether you hedge inflation or look for a return that outpaces inflation, here's how to prepare. More |