NEW YORK (CNNMoney.com) -- Home prices are still falling and there are growing concerns about the potential for a commercial real estate bust. So real estate stocks are naturally soaring.

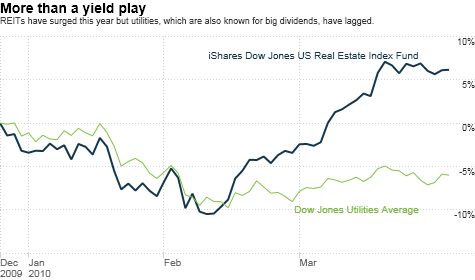

Say what? Yup, shares of real estate investment trusts, or REITs, are on fire this year. The iShares Dow Jones Real Estate (IYR) exchange-traded fund, which owns about 75 real estate stocks, is up 9% so far in 2010.

There are various types of REITs focusing on different types of properties. And REITs across the board are having a good year.

Hotel owner Host Hotels & Resorts (HST, Fortune 500), which is in the S&P 500, has shot up 25% this year. So have shares of Kimco Realty (KIM), a REIT that primarily owns shopping centers. Office property owner Boston Properites (BXP) is up nearly 15%.

What's the attraction of REITs in what remains a stormy market for residential and commercial real estate? It's tempting to sum it up in one word. Yield.

Real estate investment trusts pay at least 90% of their taxable income to shareholders in the form of dividends. Doing so exempts REITS from having to pay federal income taxes.

For that reason, REITs tend to sport eye-popping dividend yields that make them more intriguing than bonds for fixed-income investors, especially in a low interest rate environment such as this.

The yield on the iShares REIT ETF is currently 4.5%. By way of comparison, the benchmark U.S. 10-year Treasury is yielding about 3.9%.

"REITS have been running up a bit as investors chase yield. Individuals that are largely in fixed income are starting to realize that there are better investments," said Jill Cuniff, president of Edge Asset Management, a Seattle-based investment firm that runs the Principal Equity Income fund.

So the REIT rally makes sense when you consider that owning stocks that consistently pay dividends is a smart strategy for a long-term investor.

According to Ned Davis Research, stocks that steadily grow their dividends have had an average annualized return of 9.3% going back to 1972. That beats the S&P 500's average return of 7.1% and is far better than the puny return of just 1.3% for stocks that don't pay dividends.

But there's more to the real estate run than a hunt for a high yield. Jeung Hyun, principal with Adelante Capital Management, an Oakland. Calif.-based money manager, points out that another sector known for steady dividends -- utilities -- has lagged the market this year.

Hyun said that even though there are still worries about the current state of the economy, investors are anticipating improvement later this year and in 2011 -- and that's helping to lift REIT stocks.

Cuniff added that she thinks fears of a massive bust are overblown.

"There have been expectations of a commercial estate crash. We expect softness but we think some of the concerns about a crash are overdone, she said. "If real estate investors are waiting for a sell-off and huge bargains, they are not going to come."

But Cuniff said that investors need to be more cautious when looking at REITs since the sector has already enjoyed a solid run. She said investors shouldn't paint REITs with the same brush and need to focus more on individual stocks.

Along those lines, Cuniff said REITs that own hospitals and other health care facilities could benefit from the recently passed health care reform bill. One that the Principal Equity Income fund owns is simply called Health Care REIT (HCN). It pays a dividend that yields 5.9%.

Hyun said investors that are optimistic that the recovery is for real should be looking beyond defensive areas like health care though.

Because of the prolonged weakness of the economy, there hasn't been a rush to build new shopping centers, apartment buildings, hotels and offices. That will help REITs since it should keep prices stable, Hyun said.

He said his firm owns shares of Taubman Centers (TCO), a firm that owns shopping centers that yields 4%, and hotel owner Starwood Hotels and Resorts (HOT, Fortune 500). Starwood is not a REIT, however, and its yield is just 0.4%.

Cuniff said her firm is also looking at REITs that can do well in an improving economy. The Principal fund owns Annaly Capital Management (NLY), a REIT that invests in residential mortgages and yields a whopping 14.7%, and Kimco, which yields 4%.

Merger activity could help REITs as well, according to Hyun. He pointed out how General Growth Properties (GGP), a mall owner that went bankrupt last year, has surged following a takeover bid from rival Simon Property Group (SPG).

Another investment group, led by Toronto-based REIT Brookfield Asset Management (BAM), mutual fund company Fairholme and private equity firm Pershing Square are planning to invest more in General Growth to keep it independent once it emerges from bankruptcy.

"General Growth is highlighting the value in real estate," Hyun said. "The fact that there is a bankrupt company that is attracting significant investor interest is proving that."

But not everybody believes the REIT rally can go on for much longer.

Jack Ablin, chief investment officer with Harris Private Bank in Chicago, said that investors looking to buy REITs now have to realize that many are probably overvalued. The iShares REIT ETF has doubled since the market lows of a year ago, after all.

"Fundamentals haven't appeared to improve that much. The stocks were cheap a year ago but my sense now is that the real estate market is rather vulnerable," he said.

Hyun conceded that real estate investors have reasons to be worried over the next few years. Although he's not predicting a major wave of commercial real estate defaults, there is a legitimate reason why market bears keep insisting that commercial loans are the next shoe to drop.

"One thing to be worried about is that $1.4 trillion in commercial real estate mortgages mature between 2011 and 2014," he said. "What happens when those loans come due? That's the biggest hurdle for investors right now."

- The opinions expressed in this commentary are solely those of Paul R. La Monica. ![]()

| Overnight Avg Rate | Latest | Change | Last Week |

|---|---|---|---|

| 30 yr fixed | 3.80% | 3.88% | |

| 15 yr fixed | 3.20% | 3.23% | |

| 5/1 ARM | 3.84% | 3.88% | |

| 30 yr refi | 3.82% | 3.93% | |

| 15 yr refi | 3.20% | 3.23% |

Today's featured rates:

| Index | Last | Change | % Change |

|---|---|---|---|

| Dow | 32,627.97 | -234.33 | -0.71% |

| Nasdaq | 13,215.24 | 99.07 | 0.76% |

| S&P 500 | 3,913.10 | -2.36 | -0.06% |

| Treasuries | 1.73 | 0.00 | 0.12% |

| Company | Price | Change | % Change |

|---|---|---|---|

| Ford Motor Co | 8.29 | 0.05 | 0.61% |

| Advanced Micro Devic... | 54.59 | 0.70 | 1.30% |

| Cisco Systems Inc | 47.49 | -2.44 | -4.89% |

| General Electric Co | 13.00 | -0.16 | -1.22% |

| Kraft Heinz Co | 27.84 | -2.20 | -7.32% |

|

Bankrupt toy retailer tells bankruptcy court it is looking at possibly reviving the Toys 'R' Us and Babies 'R' Us brands. More |

Land O'Lakes CEO Beth Ford charts her career path, from her first job to becoming the first openly gay CEO at a Fortune 500 company in an interview with CNN's Boss Files. More |

Honda and General Motors are creating a new generation of fully autonomous vehicles. More |

In 1998, Ntsiki Biyela won a scholarship to study wine making. Now she's about to launch her own brand. More |

Whether you hedge inflation or look for a return that outpaces inflation, here's how to prepare. More |