NEW YORK (CNNMoney.com) -- Berkshire Hathaway CEO Warren Buffett defended the role that Moody's and other rating agencies played in the financial crisis, even as the industry missed the signs of an impending housing market collapse.

"They made the wrong call. I was wrong on it too," Buffett said, before a hearing of the Financial Crisis Inquiries Commission in New York on Wednesday.

|

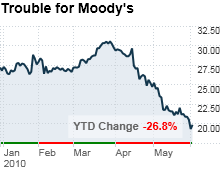

| Shares of Moody's have come under pressure in recent weeks amid the threat that Washington could enact changes in how rating agencies do business. |

Buffett, one of Moody's largest shareholders, suggested that the company, like homebuyers and investors, simply got swept up in the frenzy that defined the housing market earlier this decade.

He was also quick to defend Moody's management, including chairman and CEO Raymond McDaniel, who testified alongside Buffett Wednesday.

"In this particular case, I think they made virtually the same mistake everyone else made," said the Berkshire Hathaway (BRKA, Fortune 500) chief.

Buffett had originally declined the commission's offer to participate in the hearing, before he was later subpoenaed. Buffett did not provide prepared remarks for the hearing.

Wednesday's hearing marks the latest in a series examining the root causes of the financial crisis. So far this year, the 10-member commission has probed various culprits in the crisis including Wall Street firms, subprime lenders, as well as government agencies including the Federal Reserve and the Securities and Exchange Commission.

Critics have suggested that Moody's, as well as its main rivals, Fitch and Standard & Poor's, a division of McGraw-Hill (MHP, Fortune 500), assigned top marks to securities issued by banks that would eventually turn toxic. They have also been accused of moving too slowly to warn of the risks of bonds and other securities tied to subprime mortgages.

"Wasn't the role of the rating agencies to be refs in a game that got out of control?" asked Phil Angelides, the former treasurer for the state of California and chairman of the FCIC. "Don't we expect referees to make the call?"

Several former Moody's executives that testified Wednesday suggested that the firm strayed from that role during the housing boom, competing fiercely to rate mortgage deals produced by investment banks.

Eric Kolchinsky, a former managing director with the company's derivatives division, suggested that maintaining or growing market share became so important that the company rarely turned away deals, even if they were backed by crummy mortgages.

"While there was never any explicit directive to lower credit standards, every missed deal had to be explained and defended," Kolchinsky said.

Others highlighted some of the seemingly questionable business practices that went on within the firm during the same period of time.

Mark Froeba, a former senior vice president in the derivatives division, alleged that higher-ups within the company employed a variety of techniques to grease the wheels in the mortgage rating process, such as understaffing the residential mortgage rating group so analysts could not look at any single deal too closely.

He also cited instances in which certain analysts were blocked from participating on new deals at a banker's request out of fear that they might not assign the new security the coveted 'AAA' rating.

Assigning top ratings to mortgage-related investments were not uncommon by Moody's during the housing boom. Of the $4.7 trillion in securities backed by consumer home loans that the firm rated between 2000 and 2007, more than three-quarters of those bonds, based on dollar amount, received a 'AAA' rating, according to a preliminary staff report published by the commission.

McDaniel downplayed those allegations and also attempted to deflect some of the criticism his firm has endured since the crisis erupted, including its inability to foresee troubles in the housing market during the boom.

"We certainly believed we were on top of this and that the information we provided was adequate," he said.

He also defended the firm's "issuer-pay" business model, which some have charged led to cozy relationships between banks and the rating agencies.

His remarks were echoed by Buffett, even as he acknowledged that he "hates" that Berkshire Hathaway must pay to have any securities his firm issues rated.

"If you go to something other than user-pay it gets tricky," said Buffett.

Members of the commission also pressed McDaniel about his own personal responsibility for the firm's missteps. He has served as chairman and CEO since April 2005.

"If we reach a point where shareholders or the board don't believe I am best positioned to lead the firm through this period and into the future then I will not be in my job," said McDaniel.

The FCIC's examination of Moody's practices turns up the heat on the firm and the entire rating agency industry. Lawmakers are currently considering a number of proposals which threaten to shake up the industry.

One amendment currently on the table, proposed by Sen. Al Franken, D-Minn., would create a board to divvy up the work of rating so-called structured securities.

The company also recently revealed it is potentially facing enforcement action from the SEC after Moody's allegedly made "false and misleading" statements about its procedures when it applied to become a preferred rating agency in June 2007.

Moody's shares gained nearly 3% in afternoon trading Wednesday. ![]()

| Index | Last | Change | % Change |

|---|---|---|---|

| Dow | 32,627.97 | -234.33 | -0.71% |

| Nasdaq | 13,215.24 | 99.07 | 0.76% |

| S&P 500 | 3,913.10 | -2.36 | -0.06% |

| Treasuries | 1.73 | 0.00 | 0.12% |

| Company | Price | Change | % Change |

|---|---|---|---|

| Ford Motor Co | 8.29 | 0.05 | 0.61% |

| Advanced Micro Devic... | 54.59 | 0.70 | 1.30% |

| Cisco Systems Inc | 47.49 | -2.44 | -4.89% |

| General Electric Co | 13.00 | -0.16 | -1.22% |

| Kraft Heinz Co | 27.84 | -2.20 | -7.32% |

|

Bankrupt toy retailer tells bankruptcy court it is looking at possibly reviving the Toys 'R' Us and Babies 'R' Us brands. More |

Land O'Lakes CEO Beth Ford charts her career path, from her first job to becoming the first openly gay CEO at a Fortune 500 company in an interview with CNN's Boss Files. More |

Honda and General Motors are creating a new generation of fully autonomous vehicles. More |

In 1998, Ntsiki Biyela won a scholarship to study wine making. Now she's about to launch her own brand. More |

Whether you hedge inflation or look for a return that outpaces inflation, here's how to prepare. More |