Search News

NEW YORK (CNNMoney.com) -- All those loan problems that once plagued U.S. financial institutions don't seem so noxious anymore.

Many banks managed to put a substantial portion of their problems behind them after drastically writing down the value of those assets starting in 2007. Other institutions regained some viability after committing to scrub their books clean.

|

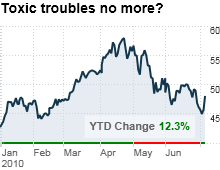

| Bank shares have held their own despite the recent market decline, suggesting investors feel a lot more confident about the underlying health of the industry. The KBW Bank index is up just over 12% so far this year. |

Citigroup (C, Fortune 500), for example, cordoned off its troubled assets in January 2009 with its creation of Citi Holdings. Over the last two quarters alone, the bank has unloaded some $56 billion in bad debt, including complex investment products like collateralized debt obligations, or CDOs.

Other banks have followed suit, albeit far less visibly, deploying teams of individuals called "special asset groups" who have been tasked with clearing out loans and other securities.

"The truth of the matter is many financial institutions are in much better shape in than in February or March of 2009," said Edwin Truman, senior fellow at the Peterson Institute for International Economics.

With bank stocks still in positive territory in 2010 despite the broader market sell-off, investors appear to agree. So far this year, the two-most closely watched indexes - the S&P Banking Index and the KBW Bank Index - are up 6% and 12% respectively.

Government-led programs that were launched at the height of the crisis have also helped alleviate the burden of bad debt facing U.S. financial institutions.

To help prop up AIG (AIG, Fortune 500), for example, the Federal Reserve spent $31.5 billion buying the troubled insurance giant's assets only to funnel them into two separate holding companies, dubbed Maiden Lane II and Maiden Lane III.

But not all of the efforts aimed at rooting out the toxic debt that has plagued banks for so long have proven effective.

The Treasury Department's Public-Private Investment Program, or PPIP, for example, promised to buy as many as $1 trillion worth of troubled securities when it was first unveiled in March of 2009.

As of late June however, the program has purchased just a fraction of that amount, roughly $12 billion in assets. It hasn't helped either that the Federal Deposit Insurance Corporation was forced to shelve the legacy loans portion of the program last June.

Critics have used those missteps as fodder against regulators. At a hearing last month, Elizabeth Warren, the chair of the Congressional Oversight Panel, the main watchdog for the Troubled Asset Relief Program, or TARP, suggested that many banks have still not yet digested all of their loan troubles, an indication that TARP may not have worked as well as the government hoped.

Banks also seem to be trying to buy more time so that the problems can resolve themselves. Many lenders have lengthened the terms of their commercial real estate loans, hoping that property values or occupancy levels will improve before long.

Other experts agree that U.S. financial institutions still have a ways to go before they are fully rehabilitated. In April, the International Monetary Fund forecast that the nation's four largest banks by assets will take another $228 billion in writedowns both this year and next.

The IMF didn't name the banks specifically, but based on Federal Reserve data, the four largest are Bank of America (BAC, Fortune 500), JPMorgan Chase (JPM, Fortune 500), Citigroup and Wells Fargo (WFC, Fortune 500).

A new proposal being floated by the Financial Accounting Standards Board is another risk to a banking recovery. Under the rule, all banks, including traditional commercial lenders, would be required to value their loans based on what is happening in the market, a move which accounting experts said could make banks' book look sickly again.

"This is going to have a huge impact on regional and local banks," said Rick Martin, vice president and head of technical accounting for Pluris Valuation Advisors.

For now, lenders can take comfort in the fact that at least some of their troubles appear to be moderating. First-quarter loan data published Wednesday by the American Bankers Association revealed that consumer delinquencies fell across a broad number of loan categories including credit cards and home equity loans.

Investors will get even more clarity about the health of those loans later this month as banks start reporting their second-quarter results.

Whether those assets continue to improve however, will largely depend on the direction of the U.S. economy.

Last week, investors were bombarded with a series of troubling economic reports, including an a renewal of job losses as well as a disastrous 30% decline in pending home sales, prompting some to suggest that another recession could be looming. That would obviously be horrible news for banks.

But even if the economy doesn't double-dip, a slower recovery will likely mean that problems for banks won't disappear overnight.

"We'll continue to see losses in some categories for a number of years," said Fred Cannon, equity strategist for Keefe, Bruyette & Woods, a boutique firm specializing in the financial services industry.

But Cannon added that given how hard banks have worked to get their financial houses in order, it would take another severe downturn in the economy for toxic assets to become another big problem again. ![]()

| Index | Last | Change | % Change |

|---|---|---|---|

| Dow | 32,627.97 | -234.33 | -0.71% |

| Nasdaq | 13,215.24 | 99.07 | 0.76% |

| S&P 500 | 3,913.10 | -2.36 | -0.06% |

| Treasuries | 1.73 | 0.00 | 0.12% |

| Company | Price | Change | % Change |

|---|---|---|---|

| Ford Motor Co | 8.29 | 0.05 | 0.61% |

| Advanced Micro Devic... | 54.59 | 0.70 | 1.30% |

| Cisco Systems Inc | 47.49 | -2.44 | -4.89% |

| General Electric Co | 13.00 | -0.16 | -1.22% |

| Kraft Heinz Co | 27.84 | -2.20 | -7.32% |

|

Bankrupt toy retailer tells bankruptcy court it is looking at possibly reviving the Toys 'R' Us and Babies 'R' Us brands. More |

Land O'Lakes CEO Beth Ford charts her career path, from her first job to becoming the first openly gay CEO at a Fortune 500 company in an interview with CNN's Boss Files. More |

Honda and General Motors are creating a new generation of fully autonomous vehicles. More |

In 1998, Ntsiki Biyela won a scholarship to study wine making. Now she's about to launch her own brand. More |

Whether you hedge inflation or look for a return that outpaces inflation, here's how to prepare. More |