FORTUNE -- David Marcus's past is filled with triumph and defeat. In the '90s he was a star protégé of mutual fund king Michael Price, the value manager who made a killing for investors in his Mutual Series funds. Marcus ran three funds there with more than $14 billion in assets and was labeled a European stock-picking ace by the press.

When Price sold his firm in the late '90s, Marcus started a hedge fund that focused on European stocks. When his biggest investor pulled out a few years later amid losses, he started another hedge fund that made money for years but got crushed in 2008 during Wall Street's meltdown. "If you think about a thousand places you didn't want to be in '08, I'd say in the top three was small-cap Europe," he recently said over breakfast.

|

| Marcus: "We're in a slow-growth environment. So what do people do in a no-growth environment? They buy growth." |

His MarCap fund dropped by more than 40% that year, and Marcus was forced to unwind positions at rock-bottom prices. Then in early 2009 he had lunch with an old friend, Eric LeGoff, and talked about their days working for Michael Price. "We were saying: Why can't we rebuild the kind of business we want to work at?" says Marcus. They wanted to create a fund management company with a collegial atmosphere, in which everyday investors could join.

So they took their time to open Evermore Global Advisors, whose two mutual funds focus on the strategy in which Marcus was schooled: deep value. That often means picking companies that other fund managers are afraid to touch. It also takes a lot of face-to-face time with management -- Marcus has a million frequent flyer miles on SAS alone.

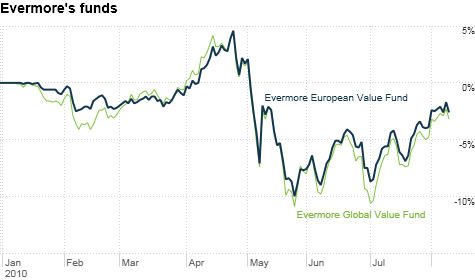

Marcus oversees both of Evermore's funds: the Evermore Global Value Fund (EVGBX) and the Evermore European Value Fund (EVEAX). We spoke him about where he's finding value now. Surprise -- it's across the pond.

To start running two mutual funds early this year, one focused solely on Europe, seems kind of maddening.

We're starting in the midst of a crisis. I think that's the best time to start. We're starting in a period of extreme stress, distress, and uncertainty. We're opportunistic -- in the funds we can go anywhere to invest. When we look, we think that the best opportunities are in Europe today. The last thing people want to do is buy European stocks. The herd is leaving. But if you look back in history, those people who bought in the midst of the crisis did the best over time.

So if you're going into Europe, where governments are starting austerity programs and economic growth is going to be slower, what's attractive?

What we have going on is a wave of restructuring throughout Europe. Right in the middle of that is Siemens, which is going through one of the greatest restructurings since the company started 160 years ago. In the old days maybe Siemens focused on Europe first, U.S. second, Asia third. Now they're reorienting their entire business. They're focusing on Asia first, U.S. second, and Europe third. To do it, first of all, they have the first non-German CEO in the history of the company. To Germans it's huge.

And Siemens has had the lowest operating margins in every division versus the competition. So the scope for cost cutting is significant. They're moving production out of Germany to cheaper countries and maybe closer to the markets where they're seeing the growth.

It's got all the elements that we're looking for and a compelling valuation. The market doesn't really see it. The market will see it after the fact. Why? When companies are refocusing, streamlining -- typically at the end of that, they're cleaner, they're purer, and investors like companies that are more focused. They get higher multiples.

But Siemens isn't an unknown story. The market is watching them go through this, right? Do you just trust that they'll get through it, and the market is pricing that with some skepticism?

I think the market doesn't understand the magnitude. People say, "Oh, that's Siemens. They don't change." People just assume it's not changing. I don't think they give enough credit to the fact that when you change the margins there by half a percent, three-quarters of a percent, you're talking about tens of millions of dollars of additional earnings.

What else are you finding?

Then there are companies like the conglomerate Bolloré in France. It owns 30% of Havas, the advertising group. They own 30% of Aegis, the U.K. advertising group. They make batteries for electric cars. They are the largest distributor of home heating oil in France. They have logistics businesses throughout Asia.

So I'm buying a French company and getting humongous exposure to emerging markets like Africa. Most people look at it and say, well, this is an old conglomerate run by the Bolloré family and there's nothing going on there. I look at it and I see a dynamic group trading at 50 cents on the dollar.

If I'm looking globally, and I say, "Well, there's growth in Africa." it's one of the last of the great emerging market opportunities, but the stock markets in Africa are sort of immature. Here I can buy a French company with international exposure and aggressive management. They've operated in those markets for over 100 years, and they're working for me as a shareholder. Plus, it's a cheap stock.

You've talked about the European companies having exposure to emerging markets. Are there other themes that you look for?

We want strategic change, because for every Siemens, there are 50 companies in Germany that say, "We're 200 years old. I'm not changing the way we do business." Those guys are going to die. If there's a theme, it's a theme of change -- structural change going on, and that's Europe coming out of old Europe.

How do you determine that the companies that you're picking within Europe aren't stuck in that cycle of poor economic growth?

That's why we avoid certain industries. I guess that's why they call it a bias. We have a bias against pulp and paper, for example. Why? They're always restructuring -- mostly to survive, not because the industry is always changing. Look, not every company in Europe is worth owning. But there are pockets of under-valued stories, whether it's Siemens, whether it's RHJ, which is a Belgium company that's shifting from Japanese assets to European assets. It could be Havas in France. People are assuming that advertising will never grow again. Nobody's ever going to spend for ads. Come on! That's what people say when you have a recession. In the meantime, they've been consolidating group divisions, streamlining.

Companies are using this crisis to be more aggressive on restructuring. We like those who get it, like a Siemens. You see that with a lot of these companies where they're aggressively changing the nature of their infrastructures.

And recent news seems to be optimistic, including the spending cuts and the European bank stress tests.

I'll tell you what else is happening in Europe that people are not focusing on. We're in a slow-growth environment. So what do people do in a no-growth environment? They buy growth. Mergers and acquisitions are growing. And then what happens? They're hostile deals. Kraft buying Cadbury, for example. Here in the U.S., you have deals like Airgas and Air Products, because the buyers are saying, "We don't care if you want to be bought or not. We're buying you; we're taking you out."

You have a wave of real M&A, strategic buyers -- not private equity guys. Then when you put into the meat grinder all these deals, what comes out the other end? Spinoffs, because when I acquire a business, I might have four units I want and two units I don't want. They sell them; they spin them off to shareholders.

So we're seeing a wave of spinoffs, all over the world.

How do you take advantage of that?

For us it's phenomenal. It's giving us so many areas to focus on. Spinoffs are notoriously under-covered. People don't understand them because they didn't exist before. It's a new company, but it's really an old company. It's new on the market. Typically they come out at compelling valuations. You're seeing a wave of spinoffs in Asia and Europe and here in the U.S.

Thanks for the time. Anything else?

You have to take advantage of the opportunities when they're there. We call this a nibbler's market because there are opportunities, but you want to have the dry powder for the next opportunity, because if you don't, then you just can't take advantage of it. ![]()

| Overnight Avg Rate | Latest | Change | Last Week |

|---|---|---|---|

| 30 yr fixed | 3.80% | 3.88% | |

| 15 yr fixed | 3.20% | 3.23% | |

| 5/1 ARM | 3.84% | 3.88% | |

| 30 yr refi | 3.82% | 3.93% | |

| 15 yr refi | 3.20% | 3.23% |

Today's featured rates:

| Company | Price | Change | % Change |

|---|---|---|---|

| Ford Motor Co | 8.29 | 0.05 | 0.61% |

| Advanced Micro Devic... | 54.59 | 0.70 | 1.30% |

| Cisco Systems Inc | 47.49 | -2.44 | -4.89% |

| General Electric Co | 13.00 | -0.16 | -1.22% |

| Kraft Heinz Co | 27.84 | -2.20 | -7.32% |

| Index | Last | Change | % Change |

|---|---|---|---|

| Dow | 32,627.97 | -234.33 | -0.71% |

| Nasdaq | 13,215.24 | 99.07 | 0.76% |

| S&P 500 | 3,913.10 | -2.36 | -0.06% |

| Treasuries | 1.73 | 0.00 | 0.12% |

|

Bankrupt toy retailer tells bankruptcy court it is looking at possibly reviving the Toys 'R' Us and Babies 'R' Us brands. More |

Land O'Lakes CEO Beth Ford charts her career path, from her first job to becoming the first openly gay CEO at a Fortune 500 company in an interview with CNN's Boss Files. More |

Honda and General Motors are creating a new generation of fully autonomous vehicles. More |

In 1998, Ntsiki Biyela won a scholarship to study wine making. Now she's about to launch her own brand. More |

Whether you hedge inflation or look for a return that outpaces inflation, here's how to prepare. More |