Search News

Click chart for more bonds and rates.

Click chart for more bonds and rates.

NEW YORK (CNNMoney.com) -- Election night is Tuesday, the Fed announcement is Wednesday, and the relief will come shortly thereafter for a bond market that has been tied in knots with speculation over the outcome of these two events.

Will the Fed engage in another round of quantitative easing? And which political party will control Congress?

Those are the two questions on investors' minds, and with good reason. The answers will have a wide reaching effect on monetary, fiscal and currency policy.

"We are not sure who the decision makers are going to be, and whether they are weighing long term or short term goals," says Michael Cheah, a bond fund manager at SunAmerica who also teaches global finance at NYU. "There is a lot of game playing going on, which makes the market very, very difficult to predict. Previously we cared about fundamentals."

Currently, it's a very sentiment driven market, with investors looking for any clues to give them a reason to buy or sell or even hold.

"This is a very confusing time," Cheah says. "As bad as 2008 was, it was pretty much, are we doomed or not? Whereas now, there are so many different policy permutations to consider."

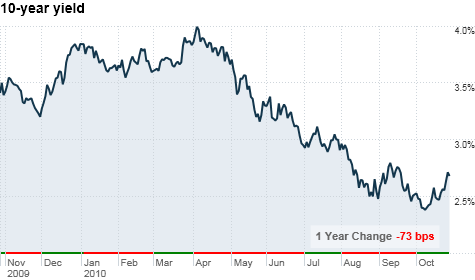

The rate on the benchmark 10-year Treasury is now hovering just above 2.7%, while the 30-year bond sits at 4.04%. The yield on the shorter term 5-year note was 1.30% on Thursday, while the 2-year note was at 0.4%

Among the latest QE2 related theories: Could the recent spike in long-term yields (a sign of bond selling) mean the long-term Treasury bond bubble finally burst?

That remains to be seen. But one thing is fairly certain. Investors will shift focus on Nov. 4 to the next round of policy decisions, according to David Coard, head of fixed income trading at Williams Capital Group.

"I think once we get passed [the election and Fed announcement], the talk will become, 'What is going on with this economy?' " Coard said.

If the lower of chamber of Congress is taken by the Republican Party, additional stimulus appears unlikely, says Coard.

And Cheah points to the Bush tax cuts as another macro-level worry for investors.

"What is difficult to predict is with [a GOP takeover], what kind of results are we going to get? Will the Bush tax cuts be extended or not? Because it's not a done deal," he said. ![]()

| Overnight Avg Rate | Latest | Change | Last Week |

|---|---|---|---|

| 30 yr fixed | 3.80% | 3.88% | |

| 15 yr fixed | 3.20% | 3.23% | |

| 5/1 ARM | 3.84% | 3.88% | |

| 30 yr refi | 3.82% | 3.93% | |

| 15 yr refi | 3.20% | 3.23% |

Today's featured rates:

| Index | Last | Change | % Change |

|---|---|---|---|

| Dow | 32,627.97 | -234.33 | -0.71% |

| Nasdaq | 13,215.24 | 99.07 | 0.76% |

| S&P 500 | 3,913.10 | -2.36 | -0.06% |

| Treasuries | 1.73 | 0.00 | 0.12% |

| Company | Price | Change | % Change |

|---|---|---|---|

| Ford Motor Co | 8.29 | 0.05 | 0.61% |

| Advanced Micro Devic... | 54.59 | 0.70 | 1.30% |

| Cisco Systems Inc | 47.49 | -2.44 | -4.89% |

| General Electric Co | 13.00 | -0.16 | -1.22% |

| Kraft Heinz Co | 27.84 | -2.20 | -7.32% |

|

Bankrupt toy retailer tells bankruptcy court it is looking at possibly reviving the Toys 'R' Us and Babies 'R' Us brands. More |

Land O'Lakes CEO Beth Ford charts her career path, from her first job to becoming the first openly gay CEO at a Fortune 500 company in an interview with CNN's Boss Files. More |

Honda and General Motors are creating a new generation of fully autonomous vehicles. More |

In 1998, Ntsiki Biyela won a scholarship to study wine making. Now she's about to launch her own brand. More |

Whether you hedge inflation or look for a return that outpaces inflation, here's how to prepare. More |