Search News

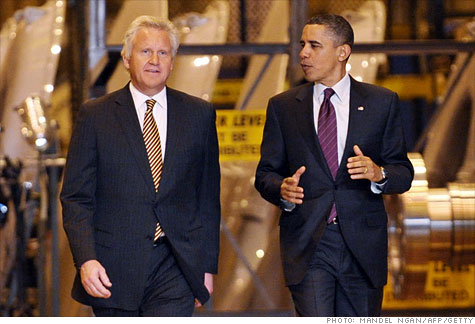

FORTUNE -- Jeff Immelt is pushing the boundaries of his role as CEO of G.E. into one of a global figurehead.

He recently gained a powerful position, replacing Paul Volcker as leader of an economic advisory council. The council, formerly called the President's Economic Recovery Advisory Board, will be renamed the President's Council on Jobs and Competitiveness.

The new name is supposed to represent a shift in government focus. It's more forward looking-emphasizing creating new jobs rather than patching up old problems.

The leadership also signals a change in federal mentality, seeing as Immelt's résumé looks a lot different that Volcker's. Volcker has a long history of holding high-power economic advisory roles. Among them, he chaired the Board of Governors for the Federal Reserve System under Presidents Carter and Reagan, and is credited with helping to bring down unsustainable inflation rates during his time at that position.

Immelt, on the other hand, has been CEO of General Electric (GE, Fortune 500) since 2001, and has worked at the company since 1982--the same year that he graduated with an M.B.A. from Harvard University. His economic philosophies are based on his knowledge from the company.

But those qualifications might work with what the Obama administration wants -- not to menion the job makes a friend out of a sometime foe. Immelt has come down hard on the President's big business policy before. In July, 2010, Immelt claimed that federal over-regulation of big businesses was strangling the economic recovery.

But recently, President Obama has been pushing for a more business-friendly image. He's working through a free-trade agreement with South Korea and has made an effort to repair a formerly tense relationship with the U.S. Chamber of Commerce, in part by supporting efforts to lower corporate taxes.

Immelt, for his part, has positioned himself to weigh in on global economics. Since he took over as GE CEO in 2001, he has focused on expanding the company more than previous CEO Jack Welch, largely in foreign markets. He's also been outspoken about global business strategies and economic issues. Now, apparently, the President believes that his strategies will work on a macro scale.

Lessons from G.E. for the U.S. economy?

It helps that Immelt's strategies have worked relatively well for G.E. After weathering a tough economic period, G.E. reported earnings rose 51% for the fourth quarter of 2010 to $4.5 billion, which topped analyst expectations.

Immelt believes that his leadership approach at G.E. could translate to the U.S. government, which he outlined in an op-ed piece for the Washington Post. Key points include boosting manufacturing in the U.S. while simultaneously positioning the company-and country now-to benefit from international markets.

G.E.'s relationship with China is a good example. "It is possible to be a competitive global enterprise and still care about your home," he wrote in the Post. "In fact, it is not just possible but imperative."

It seems that China will have a major place in Obama and Immelt's goal of making the United States a leading exporter again. Someone after all will have to import. And neither corporations, governments, nor the two working in concert can afford to ignore the Chinese markets.

He outlined part of his strategy for accessing those markets in the Harvard Business Review, back in 2009. He said that major corporations would need to take innovations from emerging markets, especially China and India, then produce them on a mass scale. Immelt calls it "reverse innovation," and lists a portable ultrasound device that GE produced as an example. Immelt said that getting into emerging markets such as China and India-and China more so than India-would be vital to fending off serious competition threats from these markets.

Immelt has applied this reasoning at his own company. While he expressed doubts this past summer about China's openness towards foreign multinationals, he's also created more and more ties between China and GE.

Most recently, the company announced a deal with a major state-owned Chinese aviation firm. The company received criticism that the deal, which would involve sharing high-level technology, will eventually enable Chinese manufacturers to produce competitive products cheaper than U.S. companies.

But these are the kind of tough business decisions that companies will have to make more and more, according to Immelt's reasoning. Immelt was, noticeably, one of the few business leaders to attend a business summit at the White House this week with Chinese President Hu Jintao. The overall tone of President Hu's visit was to build a better relationship between Beijing and Washington. If that's going to be a major part of the U.S. government's new economic goals, Immelt will no doubt have some advice to give. ![]()

| Company | Price | Change | % Change |

|---|---|---|---|

| Ford Motor Co | 8.29 | 0.05 | 0.61% |

| Advanced Micro Devic... | 54.59 | 0.70 | 1.30% |

| Cisco Systems Inc | 47.49 | -2.44 | -4.89% |

| General Electric Co | 13.00 | -0.16 | -1.22% |

| Kraft Heinz Co | 27.84 | -2.20 | -7.32% |

| Index | Last | Change | % Change |

|---|---|---|---|

| Dow | 32,627.97 | -234.33 | -0.71% |

| Nasdaq | 13,215.24 | 99.07 | 0.76% |

| S&P 500 | 3,913.10 | -2.36 | -0.06% |

| Treasuries | 1.73 | 0.00 | 0.12% |

|

Bankrupt toy retailer tells bankruptcy court it is looking at possibly reviving the Toys 'R' Us and Babies 'R' Us brands. More |

Land O'Lakes CEO Beth Ford charts her career path, from her first job to becoming the first openly gay CEO at a Fortune 500 company in an interview with CNN's Boss Files. More |

Honda and General Motors are creating a new generation of fully autonomous vehicles. More |

In 1998, Ntsiki Biyela won a scholarship to study wine making. Now she's about to launch her own brand. More |

Whether you hedge inflation or look for a return that outpaces inflation, here's how to prepare. More |