Search News

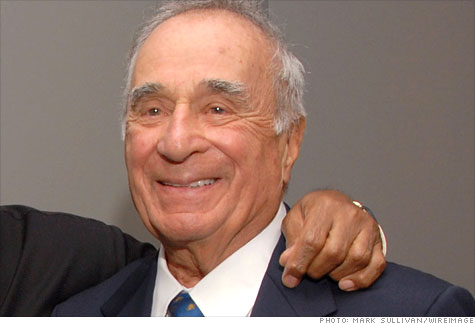

Sidney Harman -- founder of Harman International Industries and publisher of Newsweek -- died Tuesday at the age of 92.

Sidney Harman -- founder of Harman International Industries and publisher of Newsweek -- died Tuesday at the age of 92.

FORTUNE -- In the last decade of his extraordinary life, Sidney Harman -- who died this week at age 92 -- watched the price of the company he built, Harman International, peak at a giddy $132 per share and then fall to $10; was dumped by Henry Kravis of KKR; reluctantly turned the management of Harman over to a new CEO; and then improbably bought Newsweek.

Harman (HAR) International director Edward Meyer -- a longtime friend of Sidney's and the former head of advertising agency Grey -- said he was stunned by the announcement of Sidney's death because the nonagenarian had seemed so physically and mentally sharp and so obviously willing -- as the Newsweek move showed -- to take on a daunting new adventure.

Sidney's one concession to age, Meyer said, was that last year he gave up walking 18 holes of golf (where he sometimes shot a score less than his age) and started to take a cart.

Intellectual and highly articulate, Sidney (we'll call him by that name to distinguish him from the company) was also a showman. A few years ago, recalled Meyer, a Harman International business conference was unexpectedly afflicted by 15 minutes of unfilled time. The company's CEO, Dinesh Paliwal, asked if anyone had a topic he'd like to speak on. Sidney rose quickly, strode to the stage, and launched into "How It Feels to Be Retired."

Sidney hadn't exactly eased into retirement. His last years at the company were filled with drama. In 2007, KKR (KKR) agreed to buy Harman at $120 a share and then backed out. KKR claimed that Harman International's business had suffered a "material adverse effect" that allowed KKR to exit the agreement. KKR, though, never publicly described that problem, and Sidney consistently denied that there was any negative matter of importance.

The issue on the table quickly became the $225 million termination fee KKR was obligated to pay if the deal wasn't completed. Eventually the two sides negotiated an agreement that skipped the fee but required KKR to buy $400 million of five-year Harman notes, convertible at $104 a share and yielding only 1.25%.

A KKR representative, Brian Carroll, also went on Harman's board, where he remains today.

Even before the KKR deal was flourishing and then floundering, Sidney had started to put a succession plan in place. Though very uneager to step down as boss, Sidney had hired Paliwal (formerly a high-up executive at Switzerland's ABB (ABB)) to take over. It became Paliwal's lot consequently to endure both the credit crisis and the $10 bottom in Harman's stock, hit in early 2009.

Sidney probably shared in this financial pain as well. He and his wife, U.S. Rep. Jane Harman, controlled slightly more than 5% of the company's stock in October 2008. But he left Harman's board then, and there has been no indication in the company's proxy statements since of how much stock the two continued to control.

Paliwal (who is traveling abroad and not reachable) has spent his years at the company tightening its management processes and building a global footprint that reaches to China and Brazil.

And Harman's stock has recovered with the market, to a price today of about $45. Over the past three years, since spring 2008, it has handily beaten the S & P.

But that still leaves Harman miles away from the frothy days when Sidney was contemplating that KKR would pay $120 a share for the company. Fortune, writing about those days in "An Old Hand in a Strange World," quoted a philosophical Sidney as seeing "no villains, just victims, with all of us caught in a well-intended web." ![]()

| Company | Price | Change | % Change |

|---|---|---|---|

| Ford Motor Co | 8.29 | 0.05 | 0.61% |

| Advanced Micro Devic... | 54.59 | 0.70 | 1.30% |

| Cisco Systems Inc | 47.49 | -2.44 | -4.89% |

| General Electric Co | 13.00 | -0.16 | -1.22% |

| Kraft Heinz Co | 27.84 | -2.20 | -7.32% |

| Index | Last | Change | % Change |

|---|---|---|---|

| Dow | 32,627.97 | -234.33 | -0.71% |

| Nasdaq | 13,215.24 | 99.07 | 0.76% |

| S&P 500 | 3,913.10 | -2.36 | -0.06% |

| Treasuries | 1.73 | 0.00 | 0.12% |

|

Bankrupt toy retailer tells bankruptcy court it is looking at possibly reviving the Toys 'R' Us and Babies 'R' Us brands. More |

Land O'Lakes CEO Beth Ford charts her career path, from her first job to becoming the first openly gay CEO at a Fortune 500 company in an interview with CNN's Boss Files. More |

Honda and General Motors are creating a new generation of fully autonomous vehicles. More |

In 1998, Ntsiki Biyela won a scholarship to study wine making. Now she's about to launch her own brand. More |

Whether you hedge inflation or look for a return that outpaces inflation, here's how to prepare. More |