Search News

NEW YORK (Money) -- Should we save our money in early retirement or spend some of it on things like travel that we may not be able to do later on due to health and age? -- Diane Goldstein, West Windsor, N.J.

Funny, how our priorities change. During your career, the focus is on saving enough. Once you retire, your attentions shift to spending enough (but not too much).

It's a delicate trade-off. Live too frugally in the early years of retirement and later in life you could end up with a big pile of savings, as well as a big pile of regrets that you didn't enjoy yourself more when you were younger. Loosen the purse strings too much early on, and you might have to stint in your dotage.

If I could give you a formula for pulling off this balancing act, I would. But there isn't one. I can, however, suggest ways to have fun now without unduly jeopardizing your financial security later on.

Start by recognizing that your ability to engage in more vigorous pursuits can diminish quite a bit with age. Indeed, some financial planners talk about three stages of retirement: the go-go years, up to age 75, when you may travel extensively and volunteer; the slow-go years, 75 to 85, when you scale back on such activities; and the no-go years, when you're less active due to age and health. To every extent possible, you want to live large during that go-go phase.

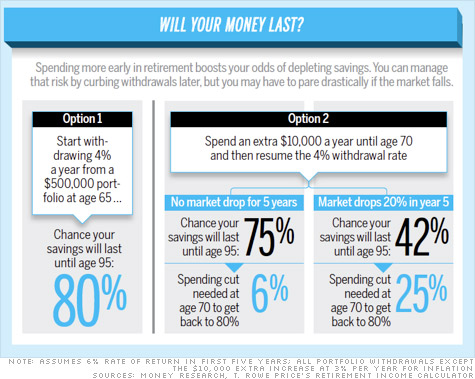

Of course, the more you spend early on, the greater the risk is that you will run out of money too soon. Start with an initial draw of 4% of your savings that you boost annually for inflation, and the odds of your dough lasting 30 years are about 80%. Up that draw to 6%, and the odds drop to about 25%.

You may, however, be able to increase your spending for trips and entertainment in the initial stage of retirement without unduly jeopardizing your financial security if you're willing to pare back on spending later on -- or accept a somewhat higher risk of running out of money.

As the chart above shows, however, if you spend more freely and your savings stash gets whacked by a market setback, you may have to make a painful adjustment to your spending or face a substantial risk of depleting your savings.

Another way to go is to cover all or nearly all of your absolutely essential expenditures with guaranteed income. If Social Security and pensions don't generate enough income to do that, you could devote a portion of your savings to an immediate annuity.

You can feel more confident about tapping your savings for splurges knowing that you've got the basics covered (although you'll still want to leave a reserve for health care expenses, which become a major wild card in that no-go phase).

Ultimately, the key is being flexible and taking your spending cues from the size of your nest egg. If surging markets are boosting its value, you may be able to indulge yourself. If you've just come off a market downturn or string of lousy returns, foregoing an inflation increase or scaling back your withdrawals a bit will give your stash a better chance to recover.

Plugging your age, savings balance and annual spending into the T. Rowe Price's Retirement Income Calculator will give an estimate of the chances your portfolio will last to age 95. You can then reduce outlays if the odds are too low for your liking -- or take another trip if they're within your comfort zone. ![]()

Carlos Rodriguez is trying to rid himself of $15,000 in credit card debt, while paying his mortgage and saving for his son's college education.

| Overnight Avg Rate | Latest | Change | Last Week |

|---|---|---|---|

| 30 yr fixed | 3.80% | 3.88% | |

| 15 yr fixed | 3.20% | 3.23% | |

| 5/1 ARM | 3.84% | 3.88% | |

| 30 yr refi | 3.82% | 3.93% | |

| 15 yr refi | 3.20% | 3.23% |

Today's featured rates: