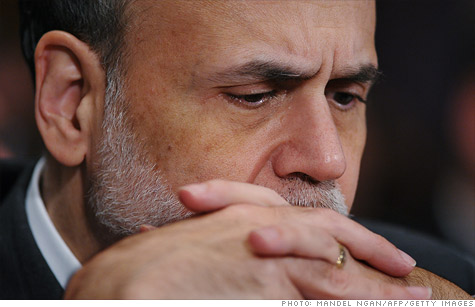

Lawmakers should not 'disregard the fragility of the economic recovery,' while focusing on spending cuts, Federal Reserve Chairman Ben Bernanke said Thursday.

NEW YORK (CNNMoney) -- Sounding a bit like a broken record, Ben Bernanke once again urged lawmakers to not put the recovery at risk as they focus on slashing government spending over the long haul.

While the Federal Reserve Chairman's comments were nothing new, they seemed perfectly timed to coincide with the first meeting of the 12-member bipartisan debt super committee Thursday.

"While prompt and decisive action to put the federal government's finances on a sustainable trajectory is urgently needed, fiscal policymakers should not, as a consequence, disregard the fragility of the economic recovery," Bernanke said in a speech in Minneapolis.

Bernanke has long urged lawmakers to bring the government's finances under control and rein in spending -- but over the long-term. In the short-term, he cautioned against massive government cuts that could squelch the already sluggish recovery.

"Fortunately, the two goals--achieving fiscal sustainability...and avoiding creation of fiscal headwinds for the recovery--are not incompatible," he said.

Reiterating his comments from a speech in Jackson Hole, Wy. two weeks ago, Bernanke also said the Federal Reserve stands ready to act if needed.

"The Federal Reserve will certainly do all that it can to help restore high rates of growth and employment," he said, repeating that sentence word-for-word from the Jackson Hole speech.

But he fell short of hinting of any specific measures.

"The Federal Reserve has a range of tools that could be used to provide additional monetary stimulus," he said.

The Fed's policymaking committee is next scheduled to meet Sept. 20 and 21. That two-day meeting was originally slated to last for one day. Economists who closely watch the central bank speculate that the Fed may use the extra day to consider a stimulus measure known as Operation Twist.

Under such a policy, the Fed would replace some of the short-term bonds already on its balance sheet, with longer-term Treasuries. The controversial move, last done in the 1960s, is meant to encourage lending and borrowing by bringing long-term interest rates down.

It's called a "twist" because it brings short-term bond rates up and long-term rates down.

Even though the Fed has pledged to keep its benchmark federal funds rate near zero until the middle of 2013, if the Fed were to sell short-term securities, such as 3-month Treasury bills, that could raise their rates. The benefit of such a program is that the Fed would not have to print more money to buy more long-term bonds.

Other possible tools could include lowering the rate the Fed currently pays banks to keep cash on reserve, or laying out explicit guidelines for how the central bank would react to changes in inflation or the unemployment rate.

Answering questions after his speech, Bernanke defended himself against critics who say the Fed's policies have recently led to a weaker dollar.

The Fed's efforts to keep inflation in check and promote a stronger recovery both help the dollar in the long run, he said.

"Ultimately the policy of maximum employment and price stability is consistent with a strong dollar policy," Bernanke said.

Bernanke also addressed dissent within the Fed. Three regional Fed presidents formally voted against Bernanke at the central banks' August meeting, but Bernanke said he welcomes internal debate and opposing views.

"There's a reason why it's a committee. There are 19 people around the table when we meet to discuss monetary policy," he said. "My view is, if two people always agree, one of them is redundant." ![]()

| Overnight Avg Rate | Latest | Change | Last Week |

|---|---|---|---|

| 30 yr fixed | 3.80% | 3.88% | |

| 15 yr fixed | 3.20% | 3.23% | |

| 5/1 ARM | 3.84% | 3.88% | |

| 30 yr refi | 3.82% | 3.93% | |

| 15 yr refi | 3.20% | 3.23% |

Today's featured rates:

| Latest Report | Next Update |

|---|---|

| Home prices | Aug 28 |

| Consumer confidence | Aug 28 |

| GDP | Aug 29 |

| Manufacturing (ISM) | Sept 4 |

| Jobs | Sept 7 |

| Inflation (CPI) | Sept 14 |

| Retail sales | Sept 14 |