Search News

Bet on businesses paying dividends.

(MONEY Magazine) -- You probably felt a sinking sense of déjà vu after Standard & Poor's downgraded the credit rating of the United States. A souring economy coupled with steep stock market plunges seemed eerily reminiscent of the financial panic of 2008.

It's not. Back then banks, wallowing in bad mortgage bets, choked off credit to debt-addicted businesses. Now companies are sitting on record amounts of cash.

Result: Strategies that failed in 2008 -- read high-quality stocks and corporate bonds -- should fare better this time.

The crisis du jour, after all, is U.S. and European governments' shifting into austerity mode to deal with their own fiscal messes.

This will certainly have an impact on economic and earnings growth -- and could push the economy into recession. And the back-and-forth over whether Greece or Italy or Spain is in danger of default will make for jittery markets. If that happens, you could lose money in the short term betting on the private sector.

Send The Help Desk your questions about dividend stocks.

But the balance-sheet rehab companies have undertaken will continue to allow them to raise dividends, buy one another, and pay down debts -- and will give Wall Street confidence that those things can happen. Here's why things are different and how you can benefit:

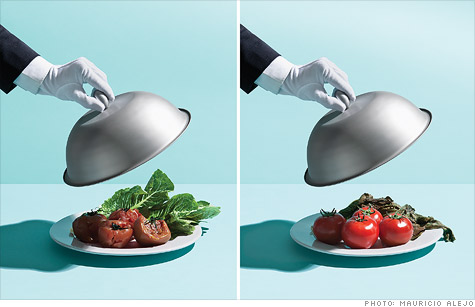

Dividends can keep rising

Stocks that pay dividends can usually withstand a downturn because their payouts cushion the market's blow. But betting on them backfired in the credit crisis, when financial firms, which accounted for nearly a third of all S&P 500 payouts, slashed payments to stay afloat. A record $58 billion in dividends were cut in 2009.

Now, thanks to big reserves and a greater mix of industries throwing off cash (financials account for just 12% of payouts today), dividend stocks can resume their role as shock absorbers.

Plus, in a slow-growth market, "we expect more of total return to come from dividends rather than capital appreciation," says Emanuele Bergagnini, Oppenheimer's investment director of growth equities.

This year, the S&P 500 Dividend Aristocrats index is down 2.9%, vs. the 6.4% loss for the broad market. You can buy a mix of reliable dividend payers through SPDR Dividend ETF (SDY). It invests only in firms that have boosted payouts annually for at least 25 years.

Growth can be bought

During the financial crisis, merger-and-acquisition activity dried up as companies, struggling to conserve cash, postponed making long-term strategic moves.

This time, global deal activity -- which is already 58% ahead of 2009's pace -- is expected to continue, say Roy Behren and Mike Shannon, co-managers of the Merger Fund (MERFX). Indeed, amid the August selloff, Google said it would shell out $12.5 billion of its $39 billion cash pot to acquire Motorola Mobility.

You can invest in funds that bet on pending deals like Merger, which is down 1.5% this year, and Gabelli ABC (GABCX), which is up 0.7%.

An indirect play: funds that focus on strong balance sheets, leading them often to firms with loads of cash. Examples from the MONEY 70: T. Rowe Price Blue Chip Growth (TRBCX) and Jensen (JENSX).

Corporate debt is solid

A sign of the faith that Wall Street has in the health of American business is the gap between what corporate bonds and Treasuries are yielding.

That spread widened from 1.7 percentage points to five points in 2008, signaling utter panic. This time, spreads have ticked up, but only by about half a point. And the gap stands at a mere 1.6 points.

True, the spread in yields between non-investment-grade "junk" bonds and Treasuries has widened by nearly two points. But it just shows that investors this time are discriminating between firms with pristine balance sheets and those that look like riskier bets.

Charles Schwab fixed-income strategist Kathy Jones prefers high-quality issues over junk bonds.

Two ETFs that bet on these bonds are SPDR Barclays Capital Intermediate Term Corporate ETF (ITR) (3.4% yield) and iShares Barclays Intermediate Credit ETF (CIU) (3.9% yield). Both tend to invest in shorter-term debt, which means they'll also be less risky should the economy improve and rates rise. Of course, that's a worry for another day. ![]()

Carlos Rodriguez is trying to rid himself of $15,000 in credit card debt, while paying his mortgage and saving for his son's college education.

| Overnight Avg Rate | Latest | Change | Last Week |

|---|---|---|---|

| 30 yr fixed | 3.80% | 3.88% | |

| 15 yr fixed | 3.20% | 3.23% | |

| 5/1 ARM | 3.84% | 3.88% | |

| 30 yr refi | 3.82% | 3.93% | |

| 15 yr refi | 3.20% | 3.23% |

Today's featured rates: