Search News

The Treasury gets 13% of the $30 billion it was allocated out the door.

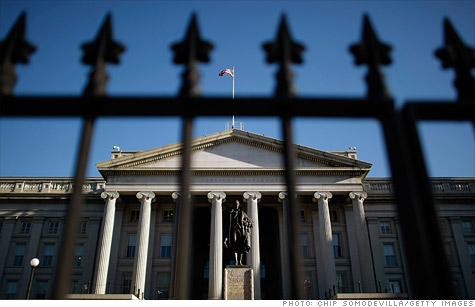

NEW YORK (CNNMoney) -- A Treasury Department program aimed at helping small businesses get their hands on cash ended this week -- with a thud.

The Small Business Lending Fund, set up last year with $30 billion to help banks jumpstart lending, disbursed a mere $4 billion, Treasury said. And it left many rejected bankers frustrated.

The news comes as small business owners complain that they cannot grow or hire because they lack access to credit. The sector has been in the spotlight as the country grapples with a sky high unemployment rate.

Reasons behind the disappointing results are myriad.

Some argue that the requirements banks had to meet to get the fund's capital were so narrow that many didn't qualify.

Others say that the demand for small business loans has been weak, because many owners are skittish about the economy. And still others say that banks are reluctant to lend to the sector because of the lack of creditworthy candidates.

The lending fund was created as part of the Small Business Jobs Act. It was intended to pump ultra-cheap capital into banks that have less than $10 billion in assets. The banks, in turn, lend the money to small businesses that need it. Treasury had to get the money to banks by Tuesday.

But only 933 community banks applied, requesting $11.8 billion. There are 7,000 community banks across the nation, according to the Independent Community Bankers of America.

Many of the banks -- 87% of them -- didn't apply for the program. To get funds, a bank had to show up front that it had a plan to lend out the money to small businesses. And for many banks, that was a challenge because the demand was not there.

"When the program was being crafted and advanced, many people believed that the economy would be much stronger," said Paul Merski, the chief economist for the community bankers association.

And for those community banks that did submit an application, but were turned away, Merski said the experience was hair-raising.

"There has been tremendous frustration by the banks that applied and were not given robust reasons why their application was asked to be withdrawn," said Merski. "There was no individual explanation of the rejection, which would be extremely frustrating if you spent a lot of time and resources sending in an application."

For its part, Treasury said that 40% of banks that applied did not meet the program's basic requirements.

Furthermore, Treasury said that it worked closely with bank regulators to determine an applicant's likelihood of repaying the loan and the bank's small business lending plan.

The "thorough application review process" was intended to protect taxpayer dollars, the department added.

Between lackluster demand from community banks and many hoops to jump through to qualify, the $30 billion lending fund sputtered, at best.

"The implementation and execution of that program was very frustrating for many of the bank applicants," said Merski, who nonetheless supported the attempt to help small businesses.

The $26 billion that did not get out the door will go back to the government's general fund. ![]()