Search News

MF Global said Corzine won't take his $12 million 'severance.' But he's at the back of a long line to get it, anyway.

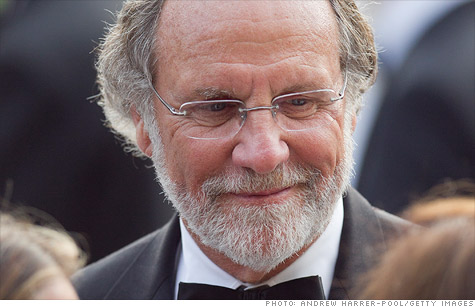

NEW YORK (CNNMoney) -- Jon Corzine, recently-resigned head of MF Global, is technically eligible to get a $12 million compensation package, though the company says he won't take it.

But even if he did want his golden parachute, analysts say he'll be at the bottom of a long list of people trying to get money from the bankrupt company. (MF Global: Sorting through the debacle.)

As part of Corzine's employment contract detailed in a March proxy filing, he's entitled to the money unless he leaves the firm "for cause," which usually means getting fired for doing something illegal, said Aaron Boyd, head of research at Equilar, an executive compensation data firm.

It wouldn't normally include things like, say, running the firm into the ground by borrowing huge amounts of money to bet on risky European assets, which is what happened at MF Global.

But something else has happened at MF Global, and investigators are trying to get to the bottom of it. More than $600 million has allegedly gone missing from the company's books. This has prompted an FBI investigation, according to a source close to the probe.

The company announced Corzine's resignation on Friday. Corzine feels "great sadness for what has transpired at MF Global and the impact it has had on the firm's clients, employees and many others," his spokesman said Friday

Corzine's involvement with the missing money is unclear, but he has retained a criminal lawyer, according to a source familiar with the matter. The lawyer, Andrew Levander, has represented other white collar clients including John Thain, former CEO of Merrill Lynch.

Corzine's would-be severance package is likely to become part of the over $2 billion in unsecured debt the company owes its creditors.

"He's at the bottom of the pile," said Brian Foley, who runs an executive compensation consultancy in White Plains, NY. "His severance rights are basically worthless."

MF Global (MF), now trading as an over the counter stock at MFGLQ (MFGLQ), did not return a call and email seeking comment.

But it's not like Corzine is broke. As the former head of Goldman Sachs (GS, Fortune 500), Corzine made hundreds of millions of dollars when the storied investment bank went public in 1999. Later he used that wealth to pursue a career in politics, serving as a New Jersey senator and then governor of that state before taking the job at MF Global in 2010.

Despite the large severance he was entitled to, it doesn't appear that Corzine was an example of execs-gone-wild while at MF Global, at least in terms of pay.

He received $4.3 million in total compensation through March of 2011, the latest period for which figures are available, according to Equilar. The next four highest-ranking executives received between $550,000 and $2.1 million over the same time-frame.

Corzine was also awarded stock options worth an estimated $11 million at the time of his hire. Those options are not included in his compensation analysis, as they were never exercised and are now worthless.

"It's not a situation where these guys made tens of millions before the whole thing went into the toilet," said Foley.

But as Foley noted, a lot of people have lost a lot of money, starting with the shareholders who saw billions in equity wiped out and the 2,800 employees who will likely have to find new jobs.

Then there's the $600 million in client money that may have been used improperly which the FBI and other regulators are now investigating.

If criminal wrongdoing is uncovered at the firm and Corzine is implicated, then he could lose more than his $12 million severance package.

"He could be in for years and years of potential litigation," said Foley.