Search News

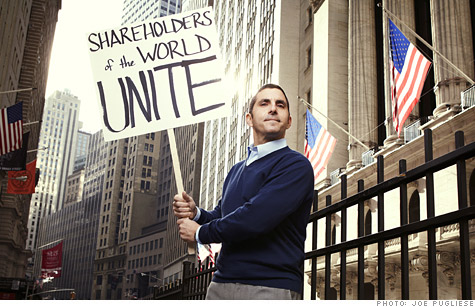

Banking analyst Mike Mayo, taking it to the street in front of the NYSE.

(MONEY Magazine) -- Mike Mayo would be a strange sight in a drum circle. He's worked at top investment houses including UBS, Deutsche Bank and now Crédit Agricole Securities. The 48-year-old banking analyst looks the classic Wall Street part: starched white shirt, short-cropped hair, athletic frame.

One reason Mayo is so fit: Whenever he gets angry he does pull-ups, or he writes. He's just finished a book and says he's up to 35 pull-ups straight. That's pretty angry. His wrath, however, isn't directed at the Occupy Wall Street protesters in Manhattan's Zuccotti Park who yell at guys like him. No, he's angry for them.

Mayo takes a notepad and draws a big circle labeled "Wall Street." Then he draws another circle for "Occupy Wall Street." In the oval where the two overlap, he writes: "Me."

"Whether you're on Wall Street or Occupy Wall Street, it doesn't matter about certain issues," he says. Among them: "Executives are still not being held accountable" for investment decisions that nearly destroyed the financial sector and caused the 2008 recession.

Mayo's book, and his testimony before the congressional committee that investigated the financial crisis, detail ways in which executives mislead investors. "I'm outraged," he says, "I'm furious."

He's not alone. A growing number of those who earn their bread -- often, a lot of bread -- in the financial sector are speaking out against inequities they say distort markets and suppress the economy.

To be sure, unlike some in the OWS camp, these folks aren't looking for a revolution: They're not quite Brooks Brothers Bolsheviks, to borrow a term from The New Republic.

Yet titans of finance, including Princeton's Burton Malkiel, author of "A Random Walk Down Wall Street," and Pimco bond guru Bill Gross -- both Republicans, by the way -- have recently warned that capitalism as it's now practiced in the U.S. diverts rewards from the deserving to the influential.

"If capitalism is working, people have a pretty fair shot," says Mayo. "If you don't create value, you don't succeed. But capitalism involves a whole lot more transparency and accountability than we've had."

The Wall Street insider critics raise issues that should alarm you as a citizen. Yet these are no mere slogan shouters. They also have ideas about how to mend the economy, and about how you can protect yourself as an investor when the playing field appears less even than it ought to be.

Fix shareholder rights

Mayo says he doesn't feel like much of an insider. In his new book, "Exile on Wall Street," he notes that his night-school MBA meant no Ivy League career-placement office ushered him into a lucrative job.

Instead, five years as a junior bank regulator at the Federal Reserve helped him land an analyst job at UBS. While analysts on Wall Street in the 1990s and early 2000s prospered by cozying up to firms they covered and persuading them to use the analysts' employers for deals that paid big fees (practices now banned), Mayo did dogged research and got into public feuds with major banks.

His outspokenness cost him at least one job, he claims. It also won him well-placed fans, including his bosses at Crédit Agricole and former Federal Reserve chairman Paul Volcker, who says he reads Mayo's work and keeps in touch with him. Mayo has also testified before Congress on ways companies try to keep damaging information from investors.

One big inequity that gets Mayo's blood boiling these days: practices that allow executives of public companies to enrich themselves even if they perform poorly.

Post-Enron reforms ended the practice of CEOs putting those beholden to them on boards' compensation committees. But often "independent" directors have subtle connections to executives, or simply go along to get along.

Case in point: the industry he covers. Mayo's research shows that financial CEO pay rose from about $5 million a year in 1998 to about $12 million in 2010. The stocks of their companies have, on average, fallen by a third.

Mayo has been harshly critical of Citigroup (C, Fortune 500), for example. The company was saved from "almost certain bankruptcy" by massive taxpayer support, he says. (Citi received at least $45 billion in government guarantees and capital during the financial crisis). Yet it shows "little humility," Mayo complains.

He objects to a new, unusual bonus plan that allows CEO Vikram Pandit to take home 0.05543% of the cumulative pretax earnings of core divisions in 2011 and 2012. Mayo says that could encourage Pandit to take risks that pay off soon but cause problems in, say, 2015.

In addition, he argues, the board set the bonus hurdle for profitability so low that Pandit is almost guaranteed to take home seven figures. Mayo fumes: "Citi was bailed out and then the board still allows these ill-conceived plans, as if they did not learn a thing." (Citi, in response, notes that Pandit worked for $1 a year in 2009 and 2010, and that it has repaid its TARP loans.)

The solution, Mayo believes, is for Congress to give shareholders more power to act as the owners they are. That sounds like common sense, but the 2010 financial reform legislation gives shareholders the right to cast only "advisory" votes on executive compensation. Shareholders need more accurate information and rules that better align executives' interests with theirs, Mayo argues. "We need real shareholder democracy."

His investment outlook:

Mayo puts a big emphasis on quality, whether you're looking at a bank stock or anything else, for that matter.

"In banks, I would go with Wells Fargo (WFC, Fortune 500) or PNC (PNC, Fortune 500) ," he says. "Those are the higher-quality banks with consistent management and strategy. They stayed away from Europe and didn't blow up during the crisis."

In other words, for now, investors, you're better off de-occupying Wall Street. ![]()

Carlos Rodriguez is trying to rid himself of $15,000 in credit card debt, while paying his mortgage and saving for his son's college education.

| Overnight Avg Rate | Latest | Change | Last Week |

|---|---|---|---|

| 30 yr fixed | 3.80% | 3.88% | |

| 15 yr fixed | 3.20% | 3.23% | |

| 5/1 ARM | 3.84% | 3.88% | |

| 30 yr refi | 3.82% | 3.93% | |

| 15 yr refi | 3.20% | 3.23% |

Today's featured rates: