Search News

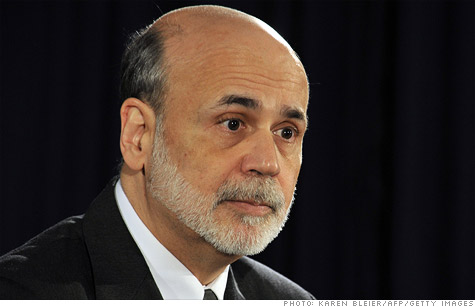

Fed Chairman Ben Bernanke, at Wednesday's news conference, says Occupy Wall Street protesters have "misconceptions" about the central bank.

NEW YORK (CNNMoney) -- America's top central banker "sympathizes" with the Occupy Wall Street protesters and thinks many of their frustrations with the sluggish economy are "understandable."

But there's one complaint Ben Bernanke does take issue with: the backlash against the Federal Reserve.

"I think that the concerns about the Fed are based on misconceptions," he said at his news conference Wednesday.

The Occupy Wall Street protests, which started in New York in September and have since spread around the world, are known for their ever-evolving and diverse list of grievances. Among them are the common themes of distaste for the banking system and frustration with government.

With that in mind, the Fed is perfectly situated as a whipping boy for the Occupy demonstrations. The Fed was created by and reports to Congress. Its top leaders are appointed by the president.

Yet, the Fed is independently funded and works as a bank, too, serving both private and foreign institutions as well as the U.S. government.

Bridging all those roles, the Fed played a main role in facilitating the government's 2008 Wall Street bailout -- which remains controversial even though parts eventually turned a profit for taxpayers.

"The Federal Reserve was involved, obviously, in trying to stabilize the financial system in 2008 and 2009," Bernanke said, in response to a question about the protests from CNNMoney. "A very simplistic interpretation of that was that we were doing that because we wanted to preserve, you know, banker salaries. That is obviously not the case."

"What we were doing was trying to protect the financial system in order to prevent a serious collapse of both the financial system and the American economy," he added. "Not everybody understands that, and therefore they sometimes misunderstand our motives. Our motives are strictly to do what's in the interest of the broad public."

Protestors have other issues with the Fed besides the bailouts. "End the Fed" signs are showing up at Occupy demonstrations across the country, and while not everyone wants to entirely dismantle the Fed, many at least want reforms.

"The Fed is really an instrument of the big banks," said Tom Siracuse, a 73-year-old Green Party supporter who turned out for the Occupy Wall Street protests last week. "It should be more democratic like this movement."

Many want more transparency, pushing for the Fed to open its policymaking meetings to the public. They want it to be more "democratic" with regional Fed presidents being chosen by elections, or at least by elected officials.

And are their complaints really based on misconceptions? Just last month, an investigation by the Government Accountability Office turned up numerous instances of conflicts of interest on the boards of the Fed's 12 regional banks.

Among the findings, it identified 18 former and current members of the Federal Reserve who have personal ties to companies that received bailout funds from the Fed.

Sen. Bernie Sanders, a Vermont independent who spearheaded the report, called it "exactly the kind of outrageous behavior by the big banks and Wall Street that is infuriating so many Americans."

As if high unemployment and a distressed housing market weren't enough to bring Fed bashing into vogue.

| Overnight Avg Rate | Latest | Change | Last Week |

|---|---|---|---|

| 30 yr fixed | 3.80% | 3.88% | |

| 15 yr fixed | 3.20% | 3.23% | |

| 5/1 ARM | 3.84% | 3.88% | |

| 30 yr refi | 3.82% | 3.93% | |

| 15 yr refi | 3.20% | 3.23% |

Today's featured rates:

| Latest Report | Next Update |

|---|---|

| Home prices | Aug 28 |

| Consumer confidence | Aug 28 |

| GDP | Aug 29 |

| Manufacturing (ISM) | Sept 4 |

| Jobs | Sept 7 |

| Inflation (CPI) | Sept 14 |

| Retail sales | Sept 14 |