Search News

Analysts say Obama has truly embraced an 'all-of-the-above' strategy, and the consumers will be the ultimate winner.

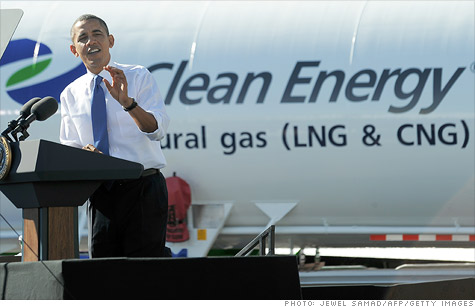

NEW YORK (CNNMoney) -- President Obama's half dozen energy proposals will, by and large, benefit nearly all players in the energy space and result in lower prices for consumers, analysts say.

When the president announced the policies during his State of the Union address last week and in appearances over the following days, the initial reaction was muted. Most of the policies are, after all, things that were either previously announced, stand little chance of passing, or are not that big of a deal.

The president still may not get all his wishes signed into law, and those in specific energy sectors may wish they had gotten more. But for the first time in a long time, analysts say the combination of Obama's plans truly represent an "all-of-the-above" approach.

"It's a smart, well balanced, welcome policy," said Jose Valera, a Houston-based lawyer in the energy practice at the global law firm Mayer Brown. "Everybody is a winner."

Natural gas: Out off all the different energy players, natural gas seems to have won the most.

In his State of the Union speech, Obama made it clear he's fully behind the continued development of natural gas in the United States.

"We have a supply of natural gas that can last America nearly one hundred years," said the president. "My administration will take every possible action to safely develop this energy."

He threw a bone to environmentalists concerned over hydraulic fracturing, saying he'll require the full disclosure of all chemicals used in the process when done on federal land.

There's concern that the chemicals used in the technology, known as fracking, are contaminating the ground water. But most states already require the disclosure Obama mentioned and most companies have already begun to do it voluntarily.

The next day Obama proposed new tax credits for vehicles that run on natural gas.

If these tax credits pass it would be good news for companies like Chesapeake (CHK, Fortune 500), Devon (DVN, Fortune 500) and EOG (EOG, Fortune 500), which will benefit from more natural gas demand. Plus Obama's support for natural gas indicates that the outright ban on fracking some environmentalists demand is unrealistic.

"The natural gas industry looks really good here," said Branko Terzic, an energy policy advisor with the consulting firm Deloitte.

Terzic, who held energy-related posts in the first Bush administration, also thought Obama's proposals will benefit all sectors.

"He understands that we have to move forward with a full portfolio of energy supply," he said.

Oil: For the oil industry, Obama offered new leases in the Gulf of Mexico and pledged to open 75% of the country's resources for drilling.

The lease sale wasn't really new, it was first proposed in 2007, and Obama had previously made the 75% commitment.

The oil industry, which basically wants to drill everywhere, welcomed the additional lease offering but wished it got more.

"A true step forward would be a plan that makes available areas offshore Virginia, throughout the Atlantic and Pacific, and the whole Eastern Gulf," the American Petroleum Institute, which represents the big players like Exxon Mobil (XOM, Fortune 500), Royal Dutch Shell (RDSA) and BP (BP) as well as a host of smaller firms, said in a statement.

Still, the lease offering is better than nothing, said Terzic. And it also demonstrates that the administration is not going to use the BP spill as an excuse to halt offshore drilling or promote an agenda that favors renewables.

"For a while there was concern that the administration was hostile to oil and gas," said Valera, whose firm negotiates oil and gas contracts. "But these comments are very positive."

Renewables: For technologies like wind and solar, Obama called for extending tax credits that basically give these firms a 30% subsidy and also called for the federal government to allow renewable projects on its land.

The proposals didn't go as far as the continuation of outright grants that some in the solar industry wanted, but are still "a big deal," according to Paul Bledsoe, a senior advisor at the Bipartisan Policy Center who served under President Clinton.

This should benefit solar panel makers like Sunpower (SPWR) and First Solar (FSLR), as well as wind turbine makers like Siemens (SI) and General Electric (GE, Fortune 500).

Moreover, although Obama essentially gave up on passing a global warming bill this year, the mere mention of it, as well as another long-shot requirement for utilities to buy more renewable power, shows that he hasn't forsaken the environmental community.

Coal and nuclear: These are the only two fuels that didn't garner an outright mention. Yet analysts say they are not unloved.

Bipartisan Policy Center's Bledsoe said the administration is on track to give the final OK on an $8 billion loan guarantee for a new nuclear plant in Georgia sometime in the next few weeks.

Coal is a little trickier. The administration has moved forward with tougher clean air laws that will shut down some coal-fired power plants (and perhaps assuage some environmentalists smarting over the fracking support).

But Obama is still thought to support clean coal and has done little else to penalize the industry or curb its rising exports to places like China and India.

"That's really the all-of-the-above approach," said Bledsoe, using the administration's jargon that was actually coined by John McCain's campaign in 2008. ''The president has always had this mentality, he's just being more explicit about it now."

The consumer: While prices for oil, which trades globally, remain relatively high, natural gas prices have plummeted, largely as a result of production increases.

Electricity from solar and wind, while still a relatively small part of the country's overall production, has risen three-fold since Obama took office, according to those industries' trade associations.

Oil and natural gas production has jumped 14% and 10% respectively, according to the Energy Information Administration. That jump is largely due to high oil prices that allow for the profitable production of oil using new technologies, but the president would sure like to take credit for it.

And the trend is expected to continue.

EIA estimates the country's oil production will grow another 20% by 2020, and as a result of that and higher fuel efficiency standards the United States will go from importing 49% of its oil in 2010 to 38% by 2020.

This is good news for anyone that heats their home with natural gas or buys products made with it like electricity or plastics.

"Ultimately, consumers will be the beneficiaries of these policies," said Mayer Brown's Valera. "And when the consumer at large wins, businesses of all type win." ![]()