Search News

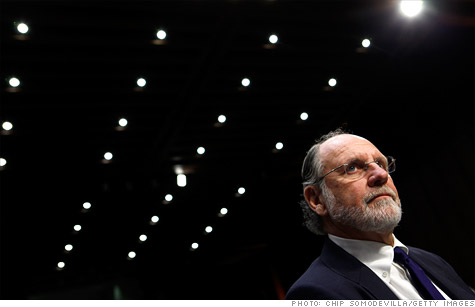

Jon Corzine appears at a hearing on Capitol Hill last year.

NEW YORK (CNNMoney) -- JPMorgan says it received "multiple clear oral assurances from senior MF Global officials" that a $175 million transfer from the firm to cover an overdraft did not include customer money.

The claim comes in testimony prepared for a Congressional hearing Wednesday on MF Global's collapse by Diane Genova, JPMorgan's deputy general counsel.

It has since emerged that the $175 million did in fact draw on customer funds, in violation of industry rules and contributing to a shortfall of some $1.6 billion. The FBI and federal regulators are now investigating, as questions swirl about who at MF Global knew that client money was being misused.

In prepared testimony, three former MF Global executives -- general counsel Laurie Ferber, Christine Serwinski, CFO of the firm's brokerage arm, and Henri Steenkamp, CFO of the parent company -- said they did not know at the time the JPMorgan transfer was made that it drew on customer funds.

The fourth, assistant treasurer Edith O'Brien, declined to testify, invoking her Fifth Amendment right against self-incrimination.

In a memo released by the House Financial Services Committee last week ahead of the hearing, investigators said O'Brien had written in an internal email that the transfer to JPMorgan (JPM, Fortune 500) came "Per JC's [Jon Corzine's] direct instructions."

Corzine, the firm's former CEO and an ex-governor and Democratic senator from New Jersey, was not on Wednesday's witness list. In testimony on Capitol Hill last year, he acknowledged ordering that the overdraft be resolved but denied specifying that customer funds be used for that purpose.

O'Brien, Corzine said, told him that the transfer had been executed legally.

MF Global was felled after its disclosure of billions of dollars worth of bets on risky European debt sparked a panic among investors. Recognizing that MF Global was in chaos in the week before it collapsed, JPMorgan pressed the firm multiple times to provide written assurances that the $175 million transfer did not violate the law.

"Mr. Corzine said he understood the request and would have someone within his organization review it," JPMorgan's Genova said.

The task of signing a letter certifying the legality of the transfer fell to O'Brien, but she declined to do so, according to last week's memo. Two days later, MF Global filed for bankruptcy following the disclosure of the missing money.

Futures brokers like MF Global can hold their own cash in customer accounts along with that of their clients, and money belonging to the firm may be transferred out freely.

In her prepared remarks, Genova said Ferber and MF Global deputy general counsel Dennis Klejna had assured JPMorgan that the $175 million consisted of MF Global money housed in a customer account.

As for why the letter certifying as much was never signed, JPMorgan believed that "given all that was happening at MF Global that day, they simply had numerous pressing matters to attend to," Genova said.

"We had no reason to doubt the clear oral assurances we had been given," she said. ![]()