Search News

The Senate on Monday is expected to take up the Buffett Rule, which would set a minimum 30% tax on millionaires and billionaires. But most small businesses are not affected.

NEW YORK (CNNMoney) -- When it comes to small businesses and the Buffett Rule, it really is about the 99%.

That is, it's likely that only 1% of small business owners would be directly affected by the latest proposal to raise taxes on the rich, according to data from the U.S. Treasury Department.

The Senate on Monday, as expected, voted down a proposal to debate the Buffett Rule, which would set a minimum 30% tax on millionaires and billionaires. But Democrats vowed to continue pushing the idea.

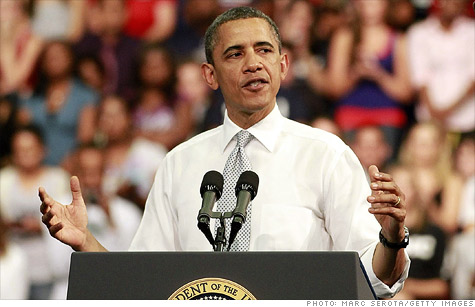

The Buffett Rule, proposed last year by President Obama, grew out of the argument that wealthy people should pay a higher share of their income in taxes than those in the middle class. Its name comes from the fact that billionaire investor Warren Buffett has said he pays a lower effective tax rate than his secretary.

Critics claim a minimum tax on millionaires would hurt small business owners, some of whom file tax returns under the individual tax code.

But federal data show that only 1% of small business owners have enough income to qualify for the Buffett Rule, according to the Treasury's Office of Tax Analysis, which reviewed filings in 2007. The report, which was issued last year, examined 20 million tax returns -- and only 273,000 would meet the Buffett Rule threshold.

Economists and tax experts don't expect the landscape has changed drastically since that study was done. Most small firms are sole proprietorships, one-person operations like Rebel Luxe in Los Angeles.

Dave "Lando" Landis has dreams of expanding his rock 'n' roll merchandise website RockerRags.com, but he's a long way from a seven-figure income. He earned just under $100,000 last year and said he wouldn't mind paying more if he ever becomes a millionaire.

"I'm absolutely for giving and supporting those who cannot help and support themselves," Landis said. "It's fair, because if you have more, you should pay more."

Three advocacy groups -- the American Sustainable Business Council, Main Street Alliance and Small Business Majority -- have come out in support of the Buffett Rule bill put forth by Democratic Sen. Sheldon Whitehouse. Their survey of 250 small businesses shows that 57% support forcing millionaires to pay a higher tax rate.

Tucker Robeson, the CEO of CDL Helpers, agrees. His six-person firm, which helps truck companies on ways to manage drivers, is growing so fast that he expects that his personal income will break the million-dollar mark in three years.

"If I end up having to pay higher taxes," said the 24-year-old Robeson, who lives in Winona, Minn. "I'll just work harder.

Of course, what the government would get, his employees wouldn't. Robeson said he would pay any extra taxes he owed from his workers' bonuses.

However, simply looking at the sheer number of small businesses over the $1 million mark misses the bigger picture, said Will McBride, an economist at the Tax Foundation, a group that advocates for lower taxes.

McBride focuses instead on the proportion of income brought in by millionaire small employers: nearly 19%.

"Income is really what matters here," he said. "That's 19% of the investable funds out there. It means less money to hire employees."

"It would have a chilling effect on investment today by these small businesses," McBride said. "And economic growth is ultimately shared by everyone."

On a similar note, the International Franchise Association has come out against the Buffett Rule, citing its own survey in which 72% of franchise owners and 43% of franchise operators say it would hurt them.

"Taxing job creators will seriously impede the ability of franchise businesses to expand their operations and create new jobs," said CEO Steve Caldeira. ![]()