Search News

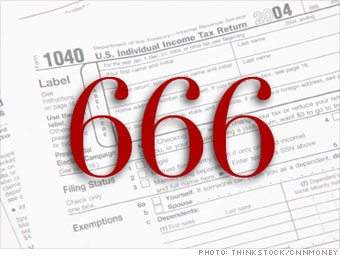

Frank Sommerville, a tax lawyer at Weycer, Kaplan, Pulaski & Zuber, P.C., had a client several years ago who told him that a new hire was refusing to fill out a W-4 because he claimed his Social Security number was the mark of the beast as referred to in Revelation in the New Testament.

The employee had bought a kit that encouraged him not to file his tax return or give an employer a W-4 form for withholding taxes; it even included templates for letters he could write to employers or the IRS to justify his position. Sommerville said the client fired this particular employee, and the employee then sued the company for religious discrimination -- but the suit was rejected.

That isn't the only instance where workers have used the "mark of the beast" argument to avoid providing employers with Social Security numbers. In another case, a man was fired from the auto body repair business he worked for after refusing to provide his Social Security number to the company to include on tax forms because he believed it represented the "mark of the beast," according to court documents. The court rejected the argument, ruling that failing to report the employee's Social Security number would have required the company to violate tax laws and subject itself to penalties.

"When these claims wind up in court, all the judges dismiss the 'mark of the beast' claims and hold that the scheme is just another tax scam," said Sommerville. "I believe that the individuals making this claim are more motivated by the alleged tax savings than by their sincerely held religious beliefs."