Search News

Following Scott Thompson's exit, Yahoo faces problems both new and old.

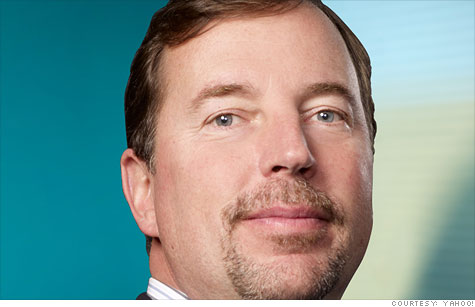

NEW YORK (CNNMoney) -- Scott Thompson, Yahoo's third CEO in about three years, has officially left the building.

That barely makes a dent in Yahoo's problems. Now that Thompson's resume-embellishing scandal has reached a resolution, Yahoo (YHOO, Fortune 500) will be forced to confront new questions -- and longtime issues that are still unsettled -- on its rough road to reinvention.

Task #1: Find a new CEO. Thompson left the company just four months into his tenure, after the discovery that his official Yahoo bio and other documents embellished his academic credentials. Thompson claimed a dual degree in "accounting and computer science," but his actual degree is only in accounting.

Now Yahoo is a rudderless ship -- again. Yahoo media chief Ross Levinsohn, who had been a rumored permanent successor to Carol Bartz (fired from Yahoo by phone in September), will serve as the interim CEO.

Analysts are waiting to see whether Yahoo will launch yet another CEO search -- a potentially lengthy and expensive process -- or stick with its in-house talent.

"Ross has been at a number of different firms, and he's had a lot of success," said Scott Kessler, equity analyst at S&P Capital IQ. "He knows media, he knows advertising. But most importantly, he is well-liked and well-respected."

Those may sound like obvious characteristics for any potential CEO, but Yahoo's recent leaders haven't fared well. Bartz's phone firing followed a tumultuous relationship with the board. Before her came Yahoo co-founder Jerry Yang, who stepped down as CEO amid shareholder anger after snubbing a $47.5 billion buyout offer from Microsoft (MSFT, Fortune 500).

"Yahoo has been dealing with different predicaments and personalities for years," Kessler said. "They really have to be enamored of the type of person Ross has proven himself to be: someone who has the vision, can communicate the strategy and gets along with people."

Make peace with new board members -- after a nasty fight. Thompson's resume issues came to light via Third Point, the activist shareholder that launched a proxy fight in February. Dan Loeb, Third Point's CEO, had proposed four new board members for Yahoo, including himself. When Yahoo wouldn't play ball, the fight got ugly.

By uncovering the resume lie, Third Point got a lot of what it wanted. In addition to Thompson's exit on Sunday, Yahoo also named three of Third Point's four nominees to the board.

One of them is Loeb himself; the other two have backgrounds that reveal where Loeb thinks Yahoo should go. Harry Wilson is the CEO of Maeva, a corporate restructuring and turnaround firm; Michael Wolf is CEO of media consulting company Activate.

The three new Third Point-nominated board members extend a year of turnover for the Yahoo board. In February, four of Yahoo's directors said they wouldn't stand for re-election. A fifth, Patti Hart, stepped down last week after Thompson's resume scandal came to light.

"The change on the board is a good one -- not so much because I know the new members will be successful, but because the old members were so unsuccessful," said Clayton Moran, a stock analyst at Benchmark Capital. "Change is a good thing for Yahoo."

Figure out Alibaba. Yahoo's Asian holdings have long been considered the company's most valuable asset.

Yahoo owns about a 40% stake in Chinese Internet giant Alibaba. But Alibaba CEO Jack Ma and Bartz had a public dispute over ownership of Alipay, an online payment unit similar to eBay (EBAY, Fortune 500)-owned PayPal.

The companies reached an agreement in July 2011, but tensions continued. Ma said at a conference in late September that Alibaba would be "interested" in buying all of Yahoo. Earlier this year, talks reportedly collapsed between Yahoo, Alibaba and Japan-based Softbank over a potential deal to sell Yahoo's stakes in Alibaba and Yahoo Japan.

Negotiations surrounding the Alibaba stake are reportedly back on, but without a permanent CEO, Yahoo may have to put those discussions on hold.

"The Asian assets are so valuable that I have to think the new board will also be interested in monetizing," Moran said. "But I would think [the Thompson debacle] means nothing is imminent."

The age-old question: What is Yahoo? Even if Yahoo scores cash by selling its Alibaba stake, it will still need to develop a roadmap for its future.

The central question of just what Yahoo is, exactly, has stumped most of its recent CEOs. The company calls itself "the premier digital media company," and its news properties do attract tons of traffic, but Yahoo has a sprawling product portfolio and a brand name with a lot of baggage attached.

Thompson tried his hand at defining Yahoo during his short tenure. Just last month, he reorganized the company into three groups: consumer, ad-focused "regions," and technology. Now, Thompson won't be there to see that vision to the end.

Like so many of his predecessors, Thompson promised a new dawn for Yahoo. The clouds have yet to break. ![]()