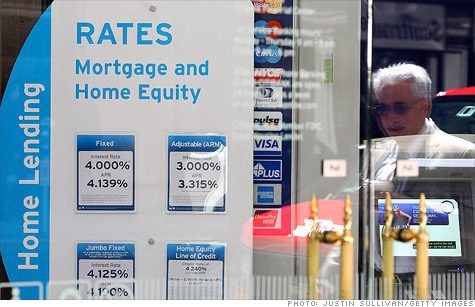

The closing costs of getting a mortgage have dropped.

NEW YORK (CNNMoney) -- Federal regulations are helping to significantly reduce the amount new homebuyers are paying come closing time.

The average cost of closing on a mortgage has fallen by 7.4% over the past year, according to a recent survey by Bankrate.com. At the end of June, a homebuyer looking to close on a $200,000 mortgage with 20% down paid an average of $3,754, $300 less than 12 months earlier.

Included in those costs are origination expenses, such as application fees and the cost of doing credit checks, and third-party fees, such as those paid for title searches and insurance.

The decline can be attributed to new regulations that require lenders to be more accurate when estimating closing costs for borrowers, said Greg McBride, Bankrate's senior financial analyst.

The regulation, which was put in place two years ago as part of the Real Estate Settlement Practices Act requires lenders to provide a "good faith estimate" of third-party fees that is within 10% of the actual amount the buyer will pay.

"The big drop in third-party fees indicates the lenders are doing a better job at estimating what the costs will be," said McBride.

The most expensive state for closing on a home was New York, where total origination fees and closing costs averaged more than $5,400 for a $200,000 mortgage, according to Bankrate. Texas, Pennsylvania and Florida also cost far more than the national average.

Missouri was the cheapest, with total borrowing costs averaging just over $3,000. Other states where closing costs remain low include Kansas, Colorado and Iowa, Bankrate said.

Even on a neighborhood level closing costs can vary significantly, said McBride. Borrowers can save money by getting at least three estimates and paying close attention to the total costs of obtaining a loan rather than getting seduced by low advertised interest rates.

"Borrowers don't want to get tunnel vision shopping for the best mortgage deal by only looking at the interest rate," he said. "Closing costs are a big line item and savings there can be quite significant." ![]()

| Overnight Avg Rate | Latest | Change | Last Week |

|---|---|---|---|

| 30 yr fixed | 3.80% | 3.88% | |

| 15 yr fixed | 3.20% | 3.23% | |

| 5/1 ARM | 3.84% | 3.88% | |

| 30 yr refi | 3.82% | 3.93% | |

| 15 yr refi | 3.20% | 3.23% |

Today's featured rates: