U.S. stock futures were higher early Friday as investors welcomed better-than-expected corporate results ahead of fresh data on home sales.

Procter & Gamble (PG) shares rose 2% after the Dow component said it earned $1.39 per share in the final three months of 2012, topping analysts estimates. The company, which makes a variety of household goods,raised its outlook for earnings and share repurchases in 2013.

Honeywell (HON) swung to a profit in the fourth quarter and issued upbeat guidance for the year. Halliburton (HAL) also reported earnings that beat analysts' expectations, driven by strength in the company's international divisions.

Overall, S&P 500 companies are expected to report earnings growth of 4.45% for the last three months of 2012, according to S&P Capital IQ.

Of the 142 companies that had reported results as of Thursday evening, 94 beat analysts' expectations.

Related: Bull market winding down. Don't panic

Investors will also get another look at the strength of the housing recovery on Friday, with the Census Bureau set to release data on new home sales for December at 10 a.m. ET.

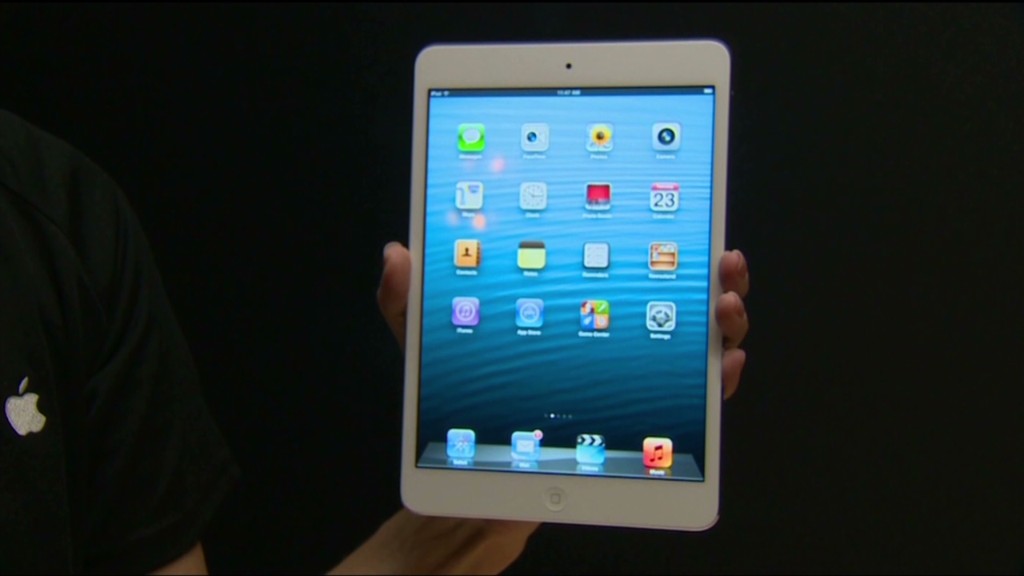

U.S. stocks ended Thursday mixed, with Apple (AAPL) weighing on the Nasdaq. The tech giant's shares fell more than 12% after it said sales in the current quarter would come in below analysts' expectations, even though earnings in the most recent quarter rose to a record $13.1 billion.

Extreme greed drives market higher

Starbucks (SBUX) shares rose 2% in premarket trading Friday, after the company reported earnings late Thursday that were in line with analysts' estimates.

Meanwhile, Microsoft (MSFT) shares sank after hours as the firm reported quarterly sales that fell short of expectations. And AT&T (T) shares were flat after the wireless carrier beat on sales but missed on earnings.

Overseas, European markets were higher in morning trading, with the DAX (DAX) in Germany adding more than 1%. London's FTSE 100 (UKX) edged higher early Friday, despite data showing the U.K. economy shrank 0.3% in the fourth quarter. The weaker-than-expected performance raised concerns that Britain could slide back into recession.

Asian markets ended mixed. Shares in Shanghai and Hong Kong fell sightly, but the Nikkei (N225)in Japan surged more than 2%. Japanese stocks have rallied as investors bet recent moves by the Bank of Japan and newly-elected prime minister Shinzo Abe will revive the nation's economy.