After hitting all-time highs earlier in the month, stock markets have taken a negative turn as investors worry about developments in Washington.

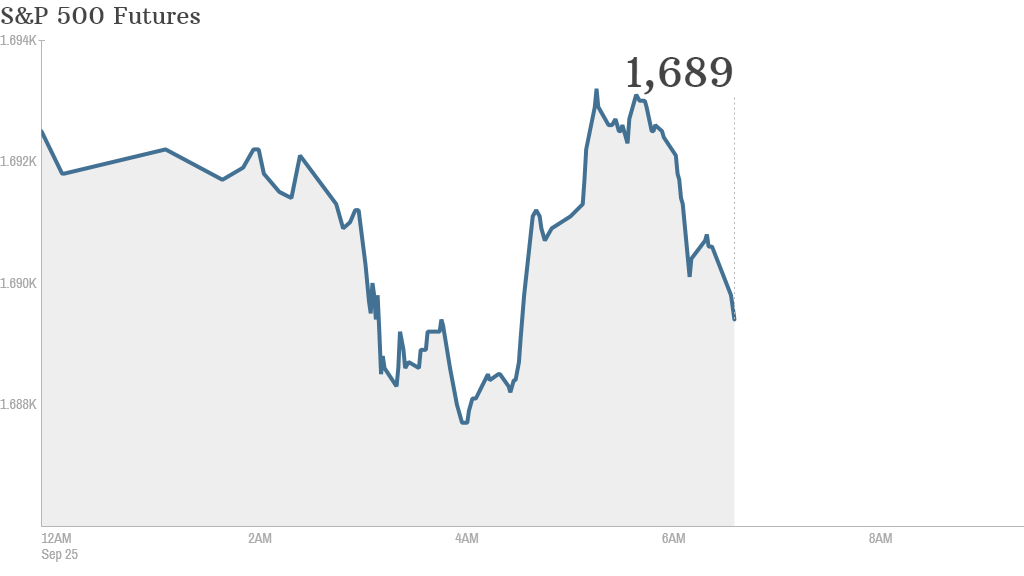

U.S. stock futures were little changed ahead of the opening bell and most global stock indexes were in the red.

There are concerns that Congress will be unable to adequately deal with the country's debt ceiling woes, which means the government risks defaulting on its debt next month. Treasury Secretary Jack Lew warned Tuesday that Wall Street should take the looming debt limit more seriously.

Investors also considered the possibility that the U.S. government might shut down on Oct. 1, which could hit economic growth.

"Debt ceiling fears have seen risk aversion return," wrote Societe Generale analyst Kit Juckes in a market report. He compared the impending government shutdown and the prospect of raising the debt ceiling to "observing a man holding a loaded shotgun, pointed at his own foot."

Related: Federal workers, surrender your iPhones during shutdown

On the economic front, the Census Bureau will release reports on durable goods orders at 8:30 a.m. ET, and on new-home sales at 10 a.m.

In corporate news, AutoZone (AZO) is set to release quarterly results before the opening bell, while Bed Bath & Beyond (BBBY) is due after the close.

Carniva (CCL)l stock declined in premarket trading after the vacation cruise company reported dismal earnings late Tuesday.

Related: Fear & Greed Index slides into fear

U.S. stocks ended mostly lower Tuesday. Both the Dow Jones Industrial Average and S&P 500 index have now suffered four straight days of losses.

Global stocks also lost ground. Asian markets ended Wednesday's session mostly lower, with Japan's Nikkei index declining 0.8%. The Shanghai Composite also weakened, but the Hang Seng in Hong Kong bucked the trend to close slightly higher.

European markets were down roughly 0.2% in midday trading.