The S&P 500 is poised to extend its record run on Monday as investor sentiment was boosted by expectations the Federal Reserve will maintain its massive liquidity program.

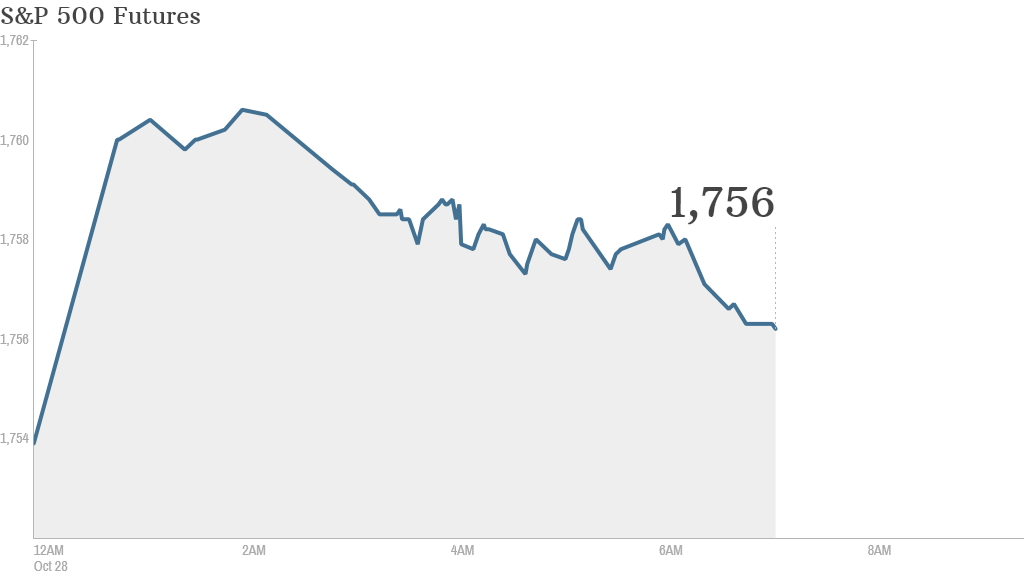

U.S. stock futures advanced, with the S&P 500 index up 0.2%.

The gains come after the S&P 500 hit a record high on Friday. The S&P, Dow and Nasdaq all rose by roughly 1% last week.

Investors have been broadly pleased by the latest batch of corporate earnings results.

Shares of Merck (MRK) edged up before the opening bell after the drug maker reported better-than-expected sales and profit, even though they slumped compared to the year-ago quarter.

Burger King (BKW) reported an increase in sales and earnings, compared to a year ago. Apple (AAPL) and Herbalife (HLF) are due to report in the afternoon.

Related: This could be Fed's largest stimulus yet

Stocks have also found recent support on hopes of continued stimulus from the Federal Reserve. The Fed has a policy meeting this week and is widely expected to say it will continue buying $85 billion in bonds and mortgage-backed securities a month. This unprecedented liquidity has buoyed equity markets around the world.

On the economic front Monday, the Census Bureau will release its monthly report on industrial production at 9:15 a.m. ET, and the National Association of Realtors publishes its monthly report on pending home sales.

Related: Investors wait for Fed, Apple and Facebook

European markets were lower in morning trading.

Nearly all Asian markets ended with gains Monday. Japan's Nikkei surged more than 2%, recovering from a near 3% drop on Friday.

Marc Chandler, strategist for Brown Brothers Harriman, said the rally was supported by strong earnings outlooks from exporters like Panasonic (PCRFF), Toyota (TM) and Canon (CAJ).