Markets were looking steady heading into the new trading week as investors shrug off weakness in Asia.

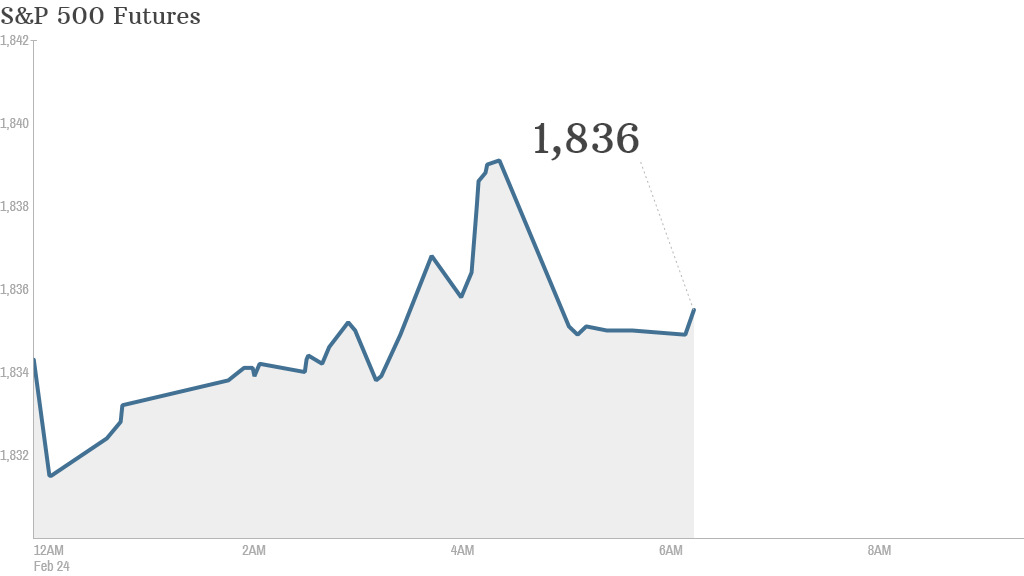

U.S. stock futures were pointing up ahead of the opening bell Monday.

Stocks in Asia were soft Monday as some investors worried about potential problems within China's red hot property market.

But there's little economic or corporate news on the docket Monday.

Investors may have to wait for Fed Chair Janet Yellen's testimony before the Senate on Thursday to provide another jolt to the market.

"A lackluster economic calendar offers little by way of market-moving event risk, opening the door for big picture [Fed-inspired] themes to take center stage," noted Ilya Spivak, a currency analyst at DailyFX.

Related: Can Yellen push S&P 500 to a record high?

U.S. investors may also be feeling optimistic after the G20 -- the world's 19 richest nations and the European Union -- pledged to install policies that will add $2 trillion to the world economy over the next five years.

Related: Fear & Greed Index idling in neutral

In the corporate world, Comcast (CCV) said Sunday that it will allow Netflix (NFLX) to connect directly to its broadband network, allowing for faster streaming.

Shares in HSBC (HSBC) were declining in London after the bank reported earnings that came in below market expectations.

Shares in Groupon (GRPN) look set for a small recovery after taking a 22% dive Friday. Shareholders pressed the sell button last week after the company warned it was expecting to report a loss in the first quarter.

On the earnings front, Solar City (SCTY) and Live Nation (LYV) will report after the closing bell.

U.S. stocks closed lower Friday. For the week, the Dow and S&P ended in the red, while the Nasdaq notched up a gain.

But the Dow Jones industrial average is up 3% this month, and the S&P 500 ended Friday just below its record high. The Nasdaq has been on fire, rising more than 4% this month.

After starting the day on the back foot, European markets were mixed. The FTSE 100 in London was being held back by HSBC.

Most Asian markets moved lower Monday, with the Shanghai Composite leading the losers with a 1.8% drop.