It's a downbeat start to Tuesday in Europe but all eyes will be on Alcoa as investors ponder whether corporate profits are strong enough to push stocks higher.

Here are the four things you need to know before the opening bell rings in New York:

1. Earnings season begins: Aluminum producer Alcoa (AA) reports earnings after the closing bell, marking the start of the quarterly results season. Restaurant chain Bob Evans (BOBE) is also due to report after the market close.

With the S&P 500 index already up 7% this year, investors will be looking closely to see whether corporate profits can support stocks and to what extent markets have been relying on cheap money from the Federal Reserve to push indexes to new records.

"I think that many investors believe that the easy monetary policy is lifting stock markets across the globe," said Brown Brothers Harriman strategist Marc Chandler. "I think there's a lot of skepticism about it."

Second quarter earnings are expected to grow 4.9% compared to the same period last year, though that estimate is down from the 6.8% prediction at the start of the quarter, according to data from FactSet.

Related: Fear & Greed Index still extremely greedy

2. International markets overview: European markets were weaker, with airline and banking stocks under pressure. Air France KLM (AFLYY) cut its earnings forecast due to overcapacity on routes to North America and Asia, and bank stocks took a hit from a New York Times report saying Germany's Commerzbank (CRZBF)and Deutsche Bank (DB) are next in line for punishment by U.S. authorities. Sentiment was also soured by weaker than expected German export data for May.

Asian markets ended mixed.

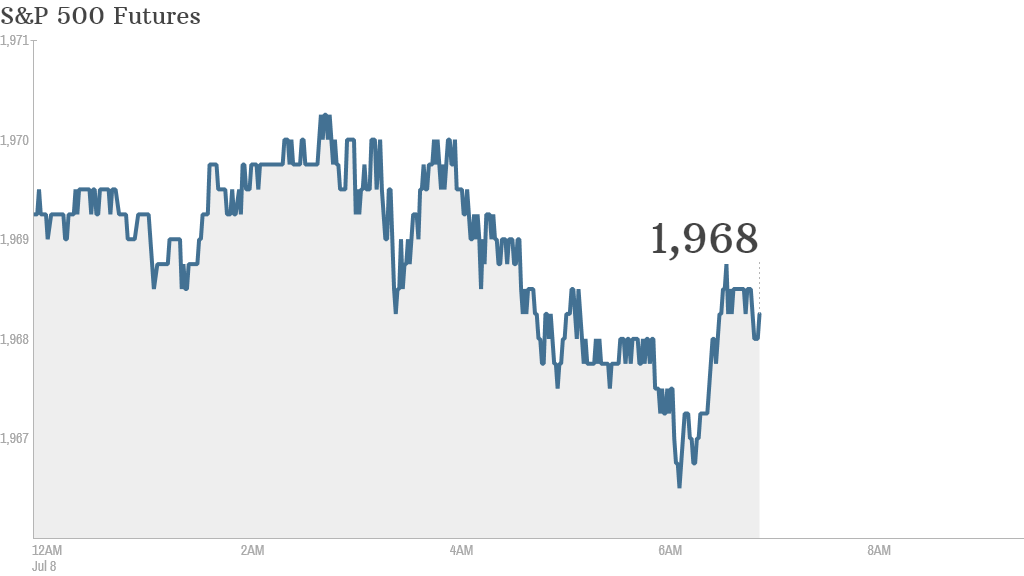

3. Futures flat: U.S. stock futures were slipping very slightly lower. Yahoo (YHOO), which derives a chunk of its value from a stake in IPO candidate Alibaba, was up 1%. Otherwise few stocks were active before the open.

U.S. stocks closed lower Monday, pulling back from record highs reached last week. The Dow Jones Industrial Average lost 44 points, while the Nasdaq closed down 0.8% and the S&P 500 was off 0.4%. Even with the decline, it was the second highest close ever for the Dow.

4. Smartphone warning: Samsung (SSNLF) warned that revenue and profit will fall in the second quarter as the company struggles to find new smartphone buyers in an already saturated market. The South Korea-based electronics maker warned that operating profit could fall to 7 trillion won ($6.9 billion) -- a 26% decline from the previous year.