Investors are very clearly in a bad mood and stocks are deep in the red.

Here are the five things you need to know before the opening bell rings in New York:

1. Jobs report: The latest monthly jobs report from the U.S. government shows the economy added 215,000 jobs in March. The unemployment rate ticked up to 5% from 4.9%.

The results were a bit better than economists had expected, but not as strong as February when the labor market added 242,000 jobs.

Eurozone unemployment data will be released Monday. The previous report showed unemployment at 10.3% across the 19 eurozone countries.

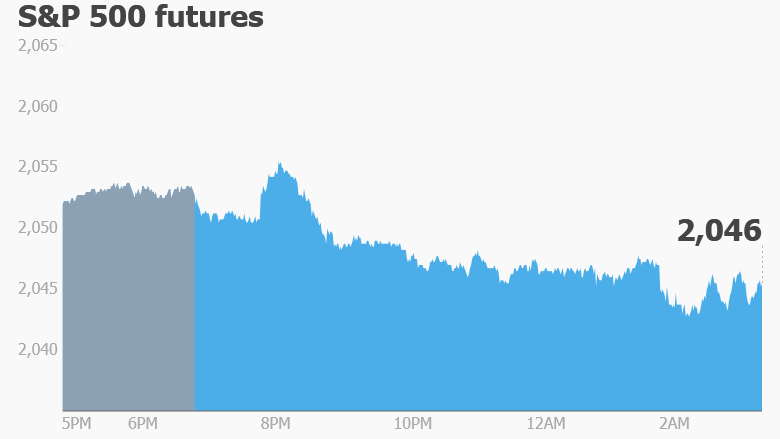

1. Bad mood in the markets: U.S. stock futures are dipping lower as nearly all major global markets drop into the red.

Most European markets are down by 1% to 2%.

Major Asian markets ended the day with losses, except for the Shanghai Composite index, which edged up by 0.2%. Tokyo's Nikkei led the march downwards in Asia, closing with a 3.6% loss.

On the commodities front, crude oil futures are slipping to trade around $37 per barrel.

3. Stocks to watch -- Starwood, Tesla: Shares in the hotel companies Marriott International (MAR) and Starwood Hotels & Resorts (HOT) are dropping in extended trading on news that China's Anbang withdrew its $14 billion offer to buy Starwood. Anbang had been in a bidding war with Marriott, which still has an offer on the table for Starwood.

Marriott and Starwood are holding an investor call at 9 a.m. to encourage shareholders to vote for the deal.

Shares in Tesla (TSLA) are shooting higher after the electric-car company unveiled its new Model 3 car, which was designed for the mass market. It's priced at $35,000.

More than 115,000 people globally have already paid roughly $1,000 to reserve a new Model 3.

Related: See Tesla's newest car

4. Earnings: Canadian firm Blackberry (BBRY) reported earnings this morning that slightly beat expectations. Trading volume in Blackberry is heavy ahead of the open.

Related: 20 stocks poised to crush earnings season

5. Thursday market recap: It ended up being a pretty lackluster day in the markets on Thursday.

The Dow Jones industrial average and S&P 500 dipped 0.2%. The Nasdaq was little changed.

Correction: An earlier version of this story incorrectly reported when eurozone unemployment data will be released.