1. Pound hits new low: The British pound dropped to a fresh 31-year low against the U.S. dollar on Tuesday as concerns mount about the long term impact of Brexit on the U.K. economy.

Bloomberg reported that the British government would not prioritize the interests of the country's huge financial services industry in its exit negotiations with the European Union. Thousands of financial firms based in the U.K. currently enjoy "passporting rights" that allow them to trade freely across Europe's markets.

But the weaker pound was helping to boost the FTSE 100 index of leading shares, which includes many big exporters and companies that earn much of their profits in dollars and other currencies.

2. Google announcement: Google is expected to reveal a collection of new tech products in San Francisco on Tuesday. They are likely to include two new smartphones aimed at taking on Apple (AAPL)'s iPhone, and Google Home, the company's answer to Amazon (AMZN)'s Echo speaker.

Related: What to expect at Google's big event

3. Stock market movers -- Deutsche Bank, Amazon: Deutsche Bank (DB) is up 2.8% in premarket trading. The bank had a rough couple of days last week.

Its stock slumped as investors worried that it may not be able to afford a looming U.S. fine for trading in toxic mortgages a decade ago.

Amazon is trading 0.6% up premarket.

Priceline (PCLN), Chipotle (CMG) and Wynn Resorts (WYNN) were up after hours Monday.

4. Earnings and economics: Olive Garden owner Darden Restaurants (DRI) is set to release its earnings before the open Tuesday. Its stock is edging 0.25% up premarket.

Micron Technology (MU) will release its latest earnings report after the closing bell. The chip maker has had an impressive streak so far this year, opening an expanded factory in Singapore last week. Its stock up over 25%.

The International Monetary Fund will release its latest World Economic Outlook at 8 a.m. ET.

Japanese consumer confidence surged in September, to the highest level in three years.

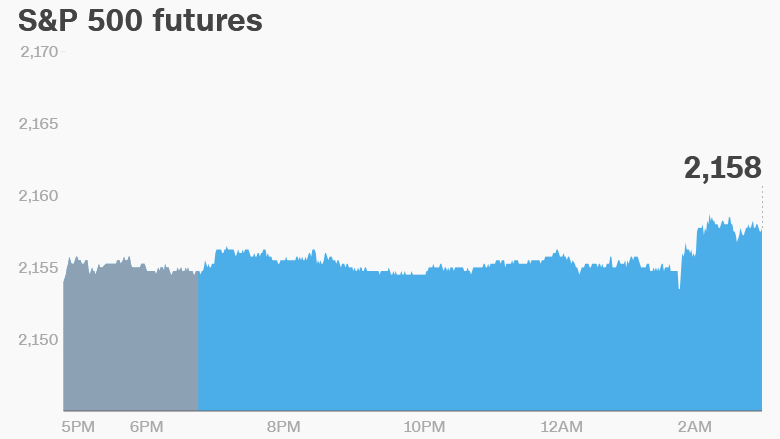

5. Markets overview: U.S. stock futures are mixed. European markets are up in early trading. Asian markets ended the session higher. Japan's Nikkei closed up thanks to a weaker yen.

The Dow Jones industrial average closed down 0.3% on Monday, while the S&P 500 was down 0.3% and the Nasdaq was down 0.2%.

6. Coming this week:

Wednesday - International trade report; Petroleum status report

Thursday - Weekly U.S. jobless claims

Friday - September U.S. jobs report