Recent buyout fundraising: $18.3 billion

Description: Characterized by a rival as the "Fidelity of private equity," Carlyle manages almost $55 billion in 48 funds across four disciplines: buyouts, venture and growth, real estate, and leveraged finance (it's also developing a multistrategy hedge fund). Founded in 1987 by William Conway Jr., Dan D'Aniello, and David Rubenstein, among others (and named after the New York City hotel), the firm has caught heat in the past for managing money from the bin Laden family and reportedly profiting from defense-related deals (which have never accounted for more than 1 percent of its total).

Lately the massive 750-person firm has been known for its global reach, with 27 offices from New York City to Mumbai to Tokyo, plus portfolio companies employing more than 200,000 people and generating $68 billion in revenues. While calling its dealmaking style conservative, Carlyle, based in Washington, D.C., still boasts an average annual return of 34 percent. In 2001, Calpers bought a 5.5 percent stake in the firm.

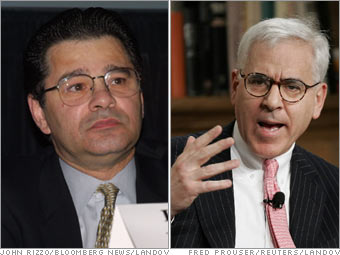

Boldface advisors: Carlyle has swapped politicos like George H.W. Bush for business leaders, including its chairman, Louis Gerstner Jr., the former IBM chairman and CEO.

Fun fact: Rubenstein and his wife met while working in the Carter administration.