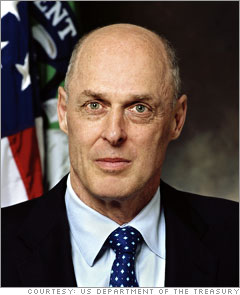

Secretary of the Treasury of the United States

While we are unmistakably experiencing volatility in our financial markets, global economic fundamentals remain healthy. That provides a solid base for financial markets to continue to adjust. The lesson here is not new--in a long period of economic expansion and benign markets, there is a temptation to give way to excesses. This has been a wake-up call. It's a reminder that all participants need to completely understand the risks they take and be vigilant.

The current strained situation will take time to play out, and more difficult news will come to light. Some investors will take losses, some organizations will fail--but the overall economy and the market are healthy enough to absorb all this. As I have said, a repricing of risk is occurring, not just in the subprime credit markets but across all capital markets. Market liquidity will ultimately be realized as investors reassess risk and return, relative to the underlying fundamentals. But again, the fundamentals are solid, our markets are resilient, and they ultimately follow the economy.

| When Wall Street fails, it asks for a handout. Fortune's Allan Sloan says there must be a better way. (more) But the Treasury Secretary tells Fortune Magazine's Nina Easton that the economy is strong enough to withstand the volatility. (more) |