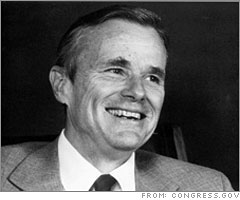

Then Chairman of Dillon Read and author of the "Brady Report" study of the crash; Later, U.S. Secretary of the Treasury

At the time I was in China walking on the Great Wall, and somebody came up to me and said that the market had crashed that day. In retrospect, that always seemed descriptive of the age - that I was in the citadel of communism and got information about the greatest free market in the world. Also, how fast this piece of information could get from New York City to the Great Wall. So I continued on my trip. I went to Paris to do some business and ran into Jim Baker, a lifelong friend, who was then Secretary of the Treasury. We agreed to fly back on the same airplane. That's about all I heard about it until President Reagan called and asked whether I would lead a commission to examine what had taken place. And I asked, "What do you have in mind?" The White House said, "We'd like to have you make a report by the first week of January." Generally this kind of investigation would take a year, not two months.

It was so much work to do quickly, and we needed a base of people to do the analysis that was necessary. I called around my friends in the industry, and we put together 40 people. The New York Federal Reserve Bank gave us a room on the tenth floor of its building. When we went in, there was one desk. When we came back in a few days, there were 20.

We worked all the way through December. I remember everyone scurrying home for Christmas Eve, and some people didn't make it because we had to have the report written and done by Jan. 8. Wives were calling on the phone asking, "Where are you?" The staff was kind of like a pickup baseball team. They were all volunteers. Some took leaves of absence from their firms. Some were freelancing one way or another. It was people from every piece of the financial scene in New York City at the time.

One of the suggestions in the report was to use circuit breakers to allow the exchange to shut down the market when certain amounts of volume came through. My thought was, what we have to do is slow this thing down for the future so the human mind can operate in a system that's moving so fast that the human mind can't contemplate it.

We delivered [the "Brady Report"] on the eighth of January. Warren Buffett said it was the finest piece of reporting of a financial event he'd ever seen. We didn't have subpoena powers, and we didn't need them. I'd say to people, "You'd better get this story straight, because it's something that can be explained, and once you explain it, intelligent things can be done about it." It's fear of the unknown that generally is most likely to produce confusion and further trouble.