Richard Branson's new firm, Virgin Money, will change the face of finance by replacing inflexible loans from big banks with a more personal, nimble approach to lending.

Earlier this year Branson bought Circle Lending, a Waltham, Mass., company founded six years ago by former management consultant Asheesh Advani, and christened it Virgin Money. The firm formalizes lending relationships among friends and family.

Rather than lend money for mortgages, student loans, and small businesses directly, Virgin Money is a third-party broker, or "marriage counselor," that manages repayment plans among friends and family members - long the major source of funding for startups.

These relationships can get emotionally complicated, and Branson believes Virgin Money can mitigate any awkwardness by handling the payments; consequently default rates decrease to 5% from 14%, claims Advani, who is staying on as CEO.

The company will also offer a small-business loan program to entrepreneurs later in 2008 or 2009. Virgin Money will match business loans made by friends and family once a borrower's good credit gets established.

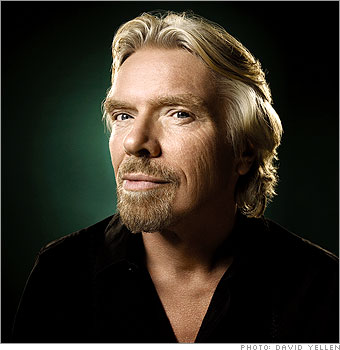

Strange as it may seem, even a billionaire like Richard Branson started out small.

Easy Money

| Behind the scenes at the Boston launch of Virgin Money, Richard Branson's new peer-to-peer lending service. (more) |