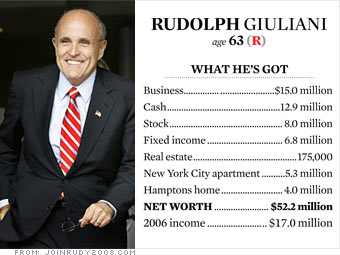

Net Worth: $52.2 million

Where he got it

Absent 9/11, Rudy Giuliani would have very likely followed the path of other retired mayors, joining a local law firm and reeling in politically connected clients. Instead he's become a publishing, consulting and speech-making juggernaut.

He received a $3 million advance for "Leadership," a tome on management that appeared in 2003. He founded Giuliani Partners, a lobbying and security consulting company that paid him an income of $4.1 million in 2006.

He became a named partner at Bracewell & Giuliani, a Houston-based law firm with close ties to the energy industry. That job pays the ex-mayor another $1 million.

But Giuliani's greatest financial triumph has been his speech-making. In 2006 he took in $11.4 million by delivering 124 talks for up to $200,000 each, one speech every three days.

Where it goes

Giuliani's finances partly reflect his somewhat messy personal life. Nearly $100,000 in assets are half owned by Donna Hanover, his second wife, whom he divorced in 2002. (She got a $6.8 million settlement, according to news reports.)

He has since married Judith Nathan, a former pharmaceutical sales rep. With her he shares about $11.6 million in assets, and she has assets of $2.4 million in her own name.

Giuliani's most significant holding is his 30 percent stake in Giuliani Partners, which has some controversial clients, including the manufacturer of Oxycontin, a powerful painkiller that the government is trying to restrict. (A Giuliani spokesman said the company never discusses engagements.)

Of the couple's nearly $28 million in investable assets, about 46 percent is in cash and 25 percent in bonds.

How he could do better

Advisers Hugh Smith and Stewart Welch note that Old Westbury funds, in which Giuliani has invested much of his money, receive only one- to three-star ratings from fund watcher Morningstar, a mediocre record. (Top-ranked funds earn five stars. Not all Westbury funds are ranked.)

They think Giuliani would be better off if he had a manager invest in individual stocks. At his asset level, that would be a cheaper alternative to actively managed mutual funds.