During the 1920s, the booming stock market roped in millions of new investors, many of whom bought stock on margin. The 1920s also witnessed a larger bubble in all kinds of credit - on cars, homes, and new appliances like refrigerators. In the years after the 1929 crash, the credit-based economy fell apart. By 1933, Wall Street and the nation's banking and mortgage industries were left for dead. The searing experience helped plunge the economy into a deep depression and spooked an entire generation of investors.

In contrast to other bubble episodes, the upside lay almost wholly in the response it stimulated. As part of the New Deal, the Roosevelt Administration and Congress created a new financial infrastructure for the nation: the Federal Deposit Insurance Corporation, which made it safe for people to bank again, the Securities and Exchange Commission, which made it safe for people to invest again, and the Investment Company Act, which laid the foundation for the modern asset management business. This infrastructure helped bring into being the nation's capital-intensive, credit-driven economy and paved the way for America's global financial dominance in the second half the 20th century.

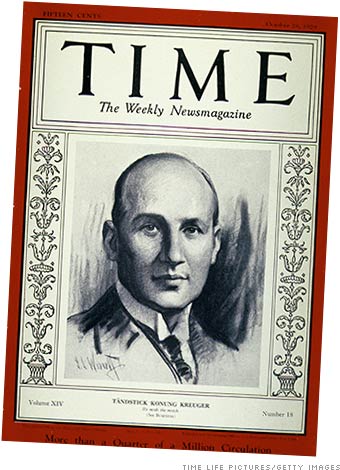

Financier Ivar Kreuger, known as the "Swedish Match King," was a leading figure in the 1920s boom. Disgraced after the market crash, he committed suicide in Paris in 1932.

The 1920s

| Fortune's Adam Lashinsky explores why Silicon Valley's premier VCs have that old-time eco-religion. (more) Robert Shiller called the tech-stock crash just as the Nasdaq peaked. But he is also the expert on the real estate market. And where does he think it's headed now? Uh-oh. (more) |