401(k) losses? Get your money back

Don't let the market meltdown derail your future. Follow our six-step guide to rebuilding your 401(k).

Fear of falling markets is understandable, but shifting entirely out of stocks would be a colossal mistake. Despite the market's meltdown, equities remain the only asset with enough growth potential to help you recoup your losses reasonably quickly and stay ahead of inflation longer term. Switch to all bonds now and, at the recent rate of 3.75% on 10-year Treasuries, you'll need about 12 years to make your money back (this assumes you started 2008 with a portfolio split 70/30 between stocks and bonds).

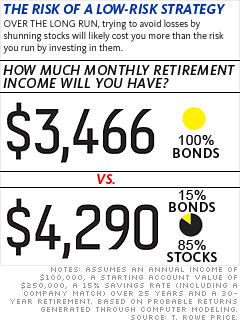

Moreover, given today's beaten-down prices, the prospects of earning above-average returns on stocks over the next market cycle look pretty good. By contrast, an all-fixed-income portfolio will generate much less income than a stock-bond blend when you're ready to retire.

NEXT: Fine-tune your asset mix

Last updated December 15 2008: 8:38 AM ET