401(k) losses? Get your money back

Don't let the market meltdown derail your future. Follow our six-step guide to rebuilding your 401(k).

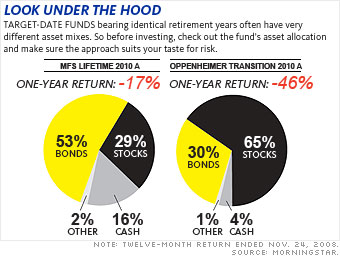

But the funds haven't lived up to their promise. Over the past year the average 2030 life-cycle fund, designed for fortysomething investors, has lost 40%. Worse, the average 2010 portfolio is down 30%, with the most aggressive versions off 40% or more - heart-stopping losses for anyone just a year away from retirement. Says Stacy Schaus, senior vice president at Pimco: "It turns out target-date retirement funds were far more volatile than most people realized."

Well, yeah. It seems there's little consensus among fund companies about the right mix of investments for retirement savers at different ages. Portfolios with the same target date often have wildly different allocations. So you have to determine your ideal blend yourself (for help, see our asset allocator). Then check the prospectus and shareholder reports to see how your target-date fund is invested. If the mix isn't right for you, switch to a fund that is.

As you approach gold-watch time, look beyond your target- date fund. The bottom line, says Pamela Hess, Hewitt's director of retirement research: "When retirement is 10 years away, target-date funds may not be the right place anymore."

NEXT: Get wise about company stock

Last updated December 15 2008: 8:38 AM ET