401(k) losses? Get your money back

Don't let the market meltdown derail your future. Follow our six-step guide to rebuilding your 401(k).

But before you cancel that retirement cruise, consider another option. If you're willing to skip cost-of-living increases in your withdrawals for a few years after you leave the work force, you just might be able to exit on schedule after all.

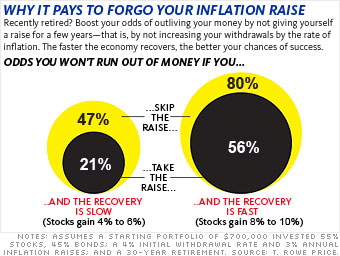

The no-raise strategy helps ensure you won't run out of money during retirement because you end up pulling out less when your portfolio's value is low, leaving more assets in your account to grow as the market rebounds. Exactly how much it helps depends on the size of your nest egg when you leave your job and how fast the economy recovers.

In general, the less you have socked away and the more slowly the market bounces back, the bigger the boost you'll get from giving up that inflation raise. On a $1 million portfolio, for instance, the strategy modestly increases the odds that your money will last throughout your retirement, from 87% to 95%. And on a $700,000 account the change is dramatic: The chances that your money won't run out rise from 56% to 80% if there's a quick rebound and from 21% to 47% if the recovery is slow, says Christine Fahlund, senior financial planner at T. Rowe Price.

You can improve those odds further by working part time. Granted, taking a dip in income or working at a part-time job may not match your idea of a dream retirement. But in tough economic times like these, it may well be the next best thing.

More galleries

Last updated December 15 2008: 8:38 AM ET