Rob McIver

Jensen Fund

Rob McIver is choosy. Each of the 30 stocks that make it into the $3 billion Jensen Fund must post a return on equity of more than 15% for each of the past 10 years. One slip in profits and the stock is out. The idea is that companies with consistent returns have long-term advantages like pricing power and smarter managers -- and thus make shareholders more money.

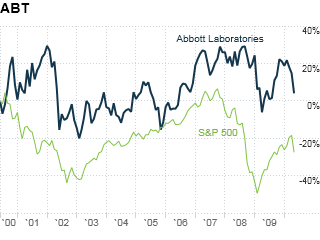

The approach has produced outstanding results: The Jensen fund beat the S&P 500 by an average 3.4 percentage points a year for the past decade. McIver calls Abbott Laboratories a stock for the long run. The pharmaceutical company has great products like Humira, the hit rheumatoid arthritis drug; a return on equity of 28%; and a huge presence in emerging markets. The stock boasts a 3.5% dividend yield and is trading at just 10 times expected earnings.

"It's a very powerful story," says McIver.

--S.C.

NEXT: Petrobras